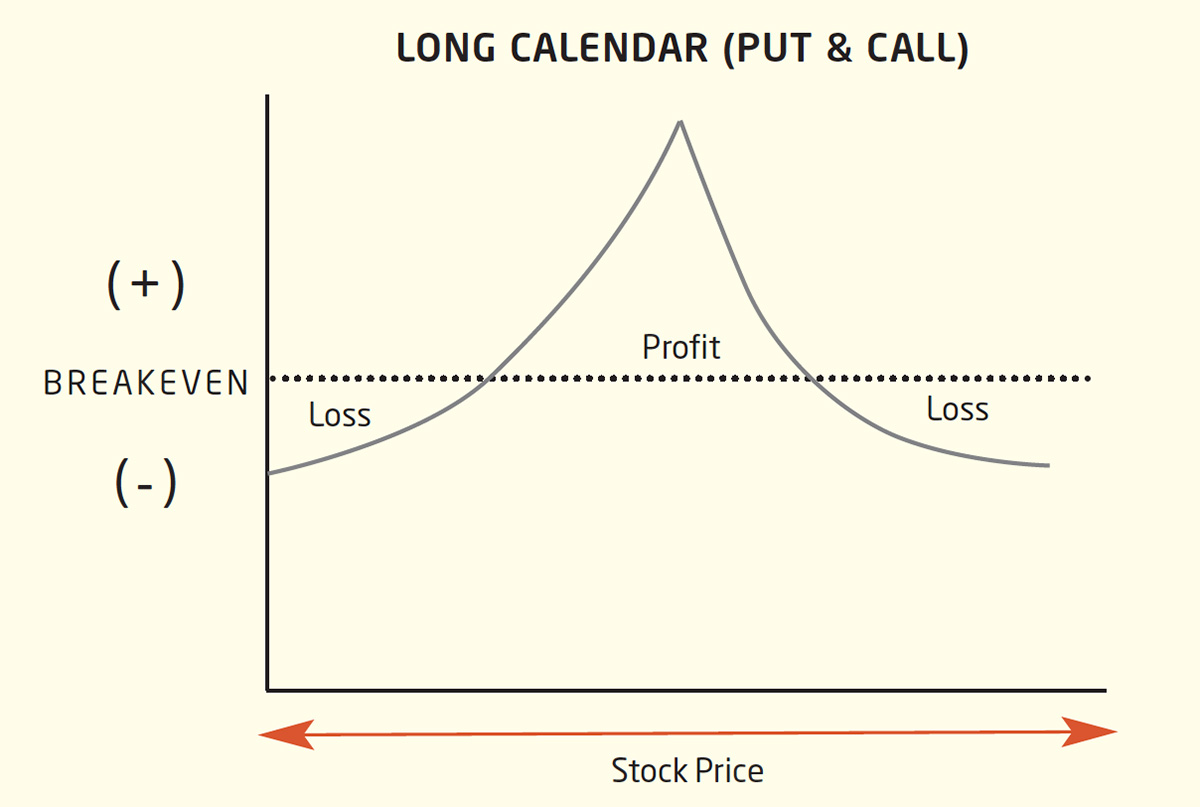

Calendar Spread Trading 2024. The Economic Calendar page keeps track of all the important events and Economic Indicators that drive the markets. A calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high probability of profit and a very favorable reward-to-risk ratio. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Top Pros' Top Picks (Daily) A calendar spread is a derivatives strategy that involves buying a longer-dated contract to sell a shorter-dated contract. In a nutshell, the calendar spread strategy allows traders to buy a longer-dated contract and sell a shorted-dated one, allowing them to create a trade that minimizes the effects of time versus holding a long option ( call/put) only. The current month's calendar is presented with today's date highlighted, with future months available for viewing.

Calendar Spread Trading 2024. One strategy that we are profiting with right now is a calendar spread. Landrieu, the director for economic policy and labor at the National. Top Pros' Top Picks (Daily) A calendar spread is a derivatives strategy that involves buying a longer-dated contract to sell a shorter-dated contract. A calendar spread is an options or futures strategy established by simultaneously entering a long and. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Calendar Spread Trading 2024.

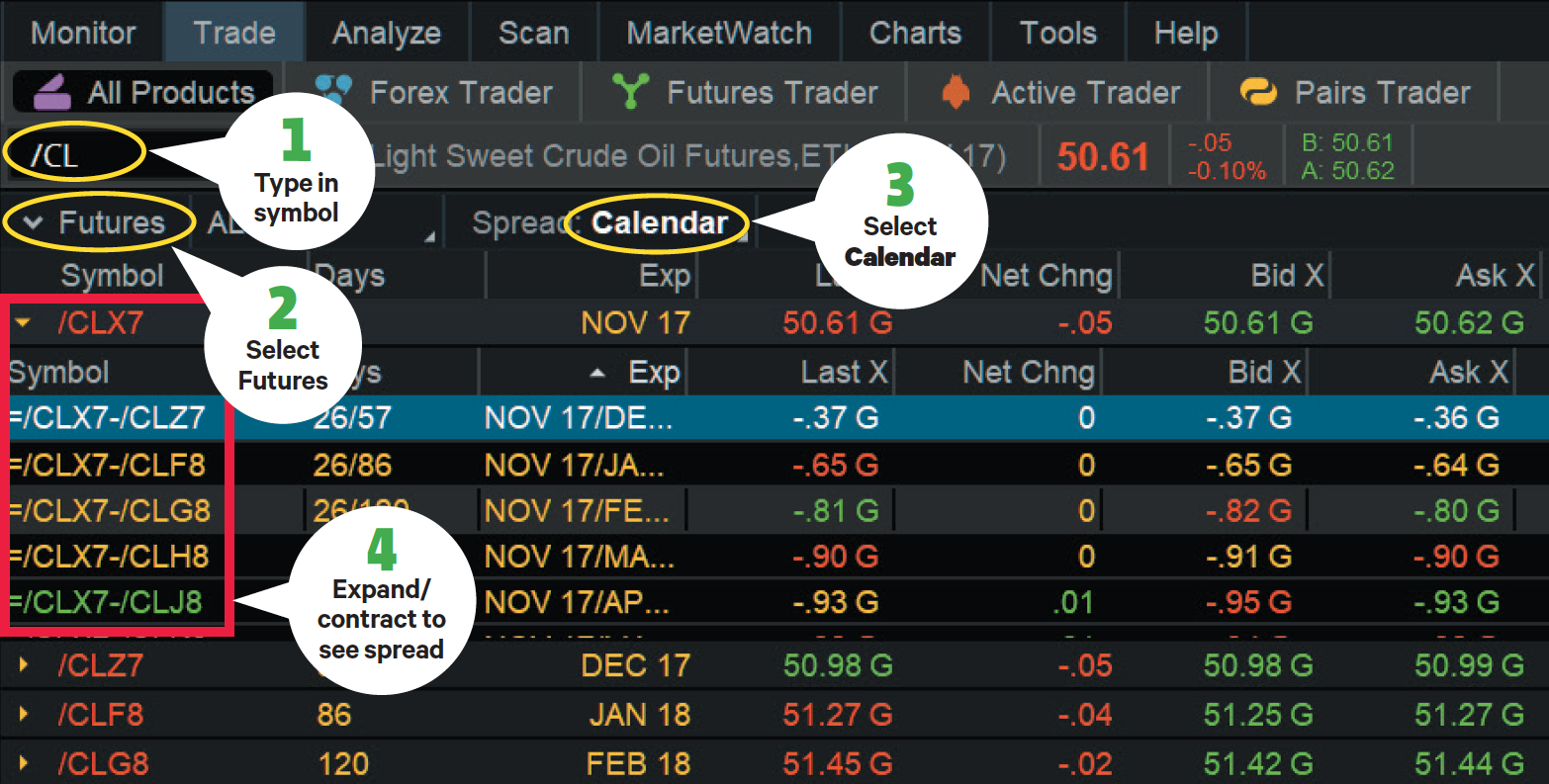

Crude Oil Futures Calendar – CME Group Find information for Crude Oil WTI Futures Overview provided by CME Group.

In a nutshell, the calendar spread strategy allows traders to buy a longer-dated contract and sell a shorted-dated one, allowing them to create a trade that minimizes the effects of time versus holding a long option ( call/put) only.

Calendar Spread Trading 2024. Grace Landrieu, a longtime aide to President Joe Biden, is departing the White House to join his reelection campaign. One strategy that we are profiting with right now is a calendar spread. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Calendar spreads allow traders to construct a trade that minimizes the results of time. The goal with this options trading strategy is to profit from differences in implied volatility between expiration cycles and/or the passage of time with a directionally neutral strategy.

Calendar Spread Trading 2024.