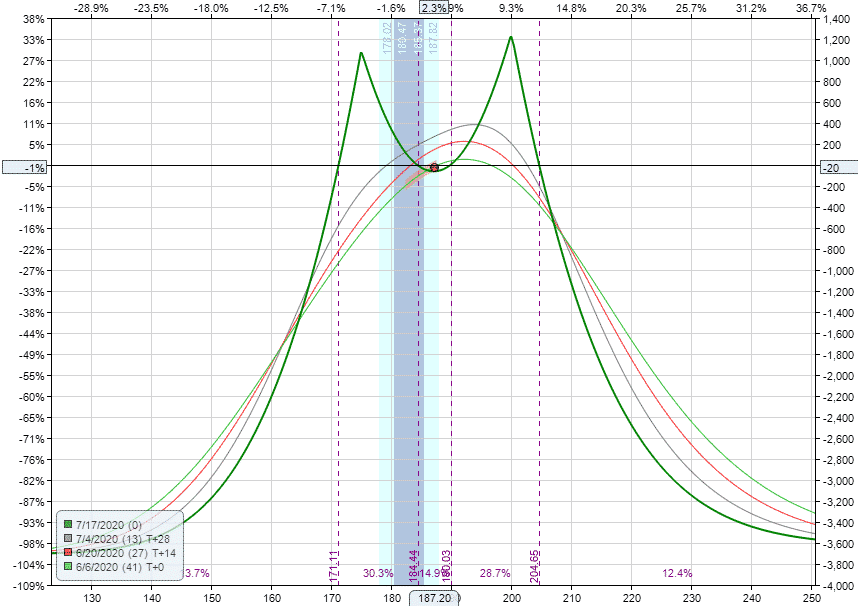

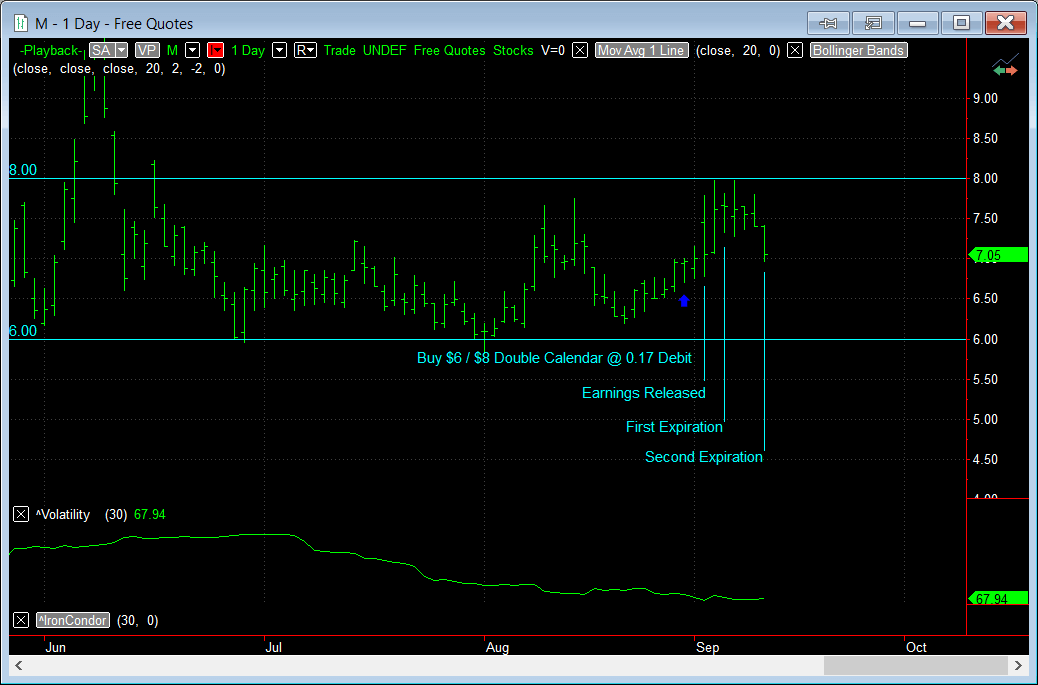

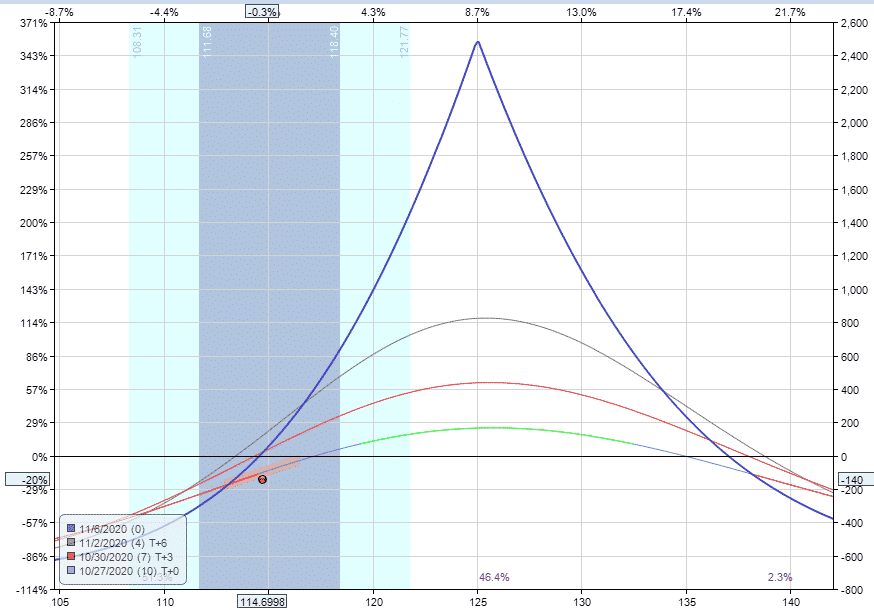

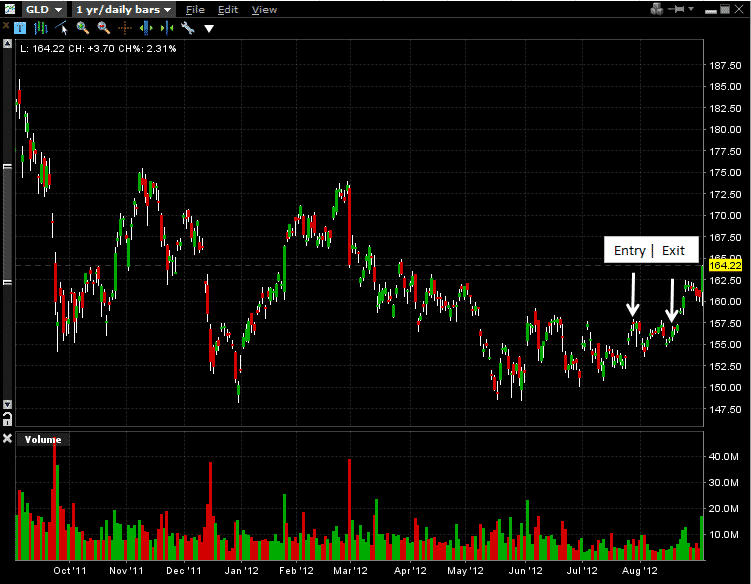

Double Calendar Spread 2024. Each monthly calendar spread features enough room to mark important dates or write down reminder notes, making them perfect for staying organized and productive all year long. A double calendar has two peaks or price points where the largest gains can be achieved. Full content visible, double tap to read brief content. A calendar spread is an options strategy created by simultaneously entering a long and a short position on the same underlying but with different expiries. Traders believes that volatility is likely to pick up shortly. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. These calendars are great for family, clubs, and other organizations. A long position is created in a far expiry and a short position in the near expiry of the same strike price and same underlying.

Double Calendar Spread 2024. While this spread is fairly advanced, it's also relatively easy to understand once you're able to look at its inner workings. Spiral Wall Calendars also make a great gift for anyone on your list! A calendar spread is an options strategy created by simultaneously entering a long and a short position on the same underlying but with different expiries. In today's video I want to talk about the double calendar spread strategy that can be very powerful on Robinhood an. The structure for each of both double calendars or double diagonals thus consists of four different, two long and two short, options. Double Calendar Spread 2024.

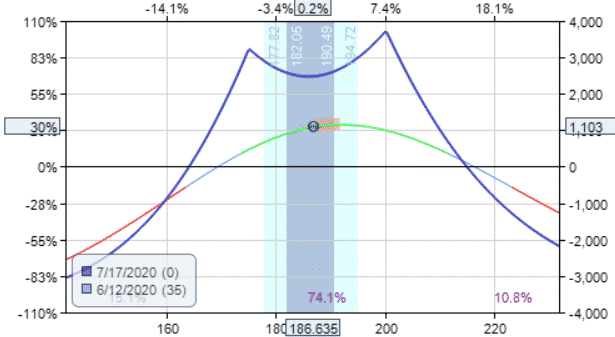

The potential max gain can change based on fluctuations in implied volatility.

Excel opens a new sheet that is based on the single-page yearly calendar template.

Double Calendar Spread 2024. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. A double calendar combines two out-of-the-money calendars: one put and one call. Here's what you need to know about double calendar spreads and how they are used in options trading. Yeah negative theta would actually be one. Next, let's see how the greeks might help humble the volatility hecklers.

Double Calendar Spread 2024.