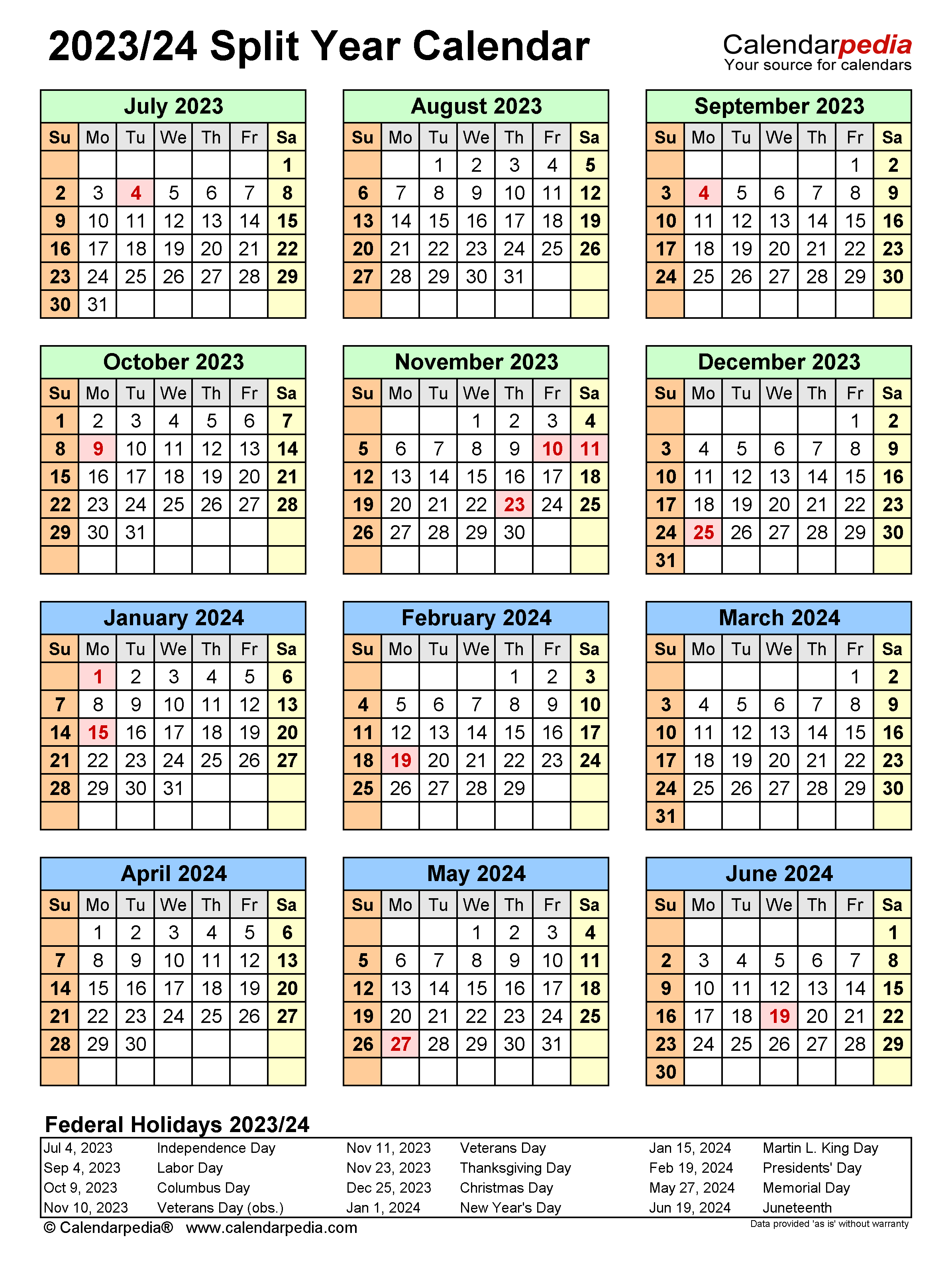

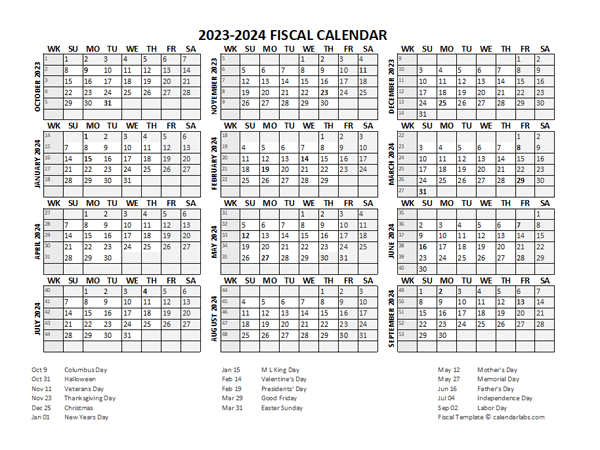

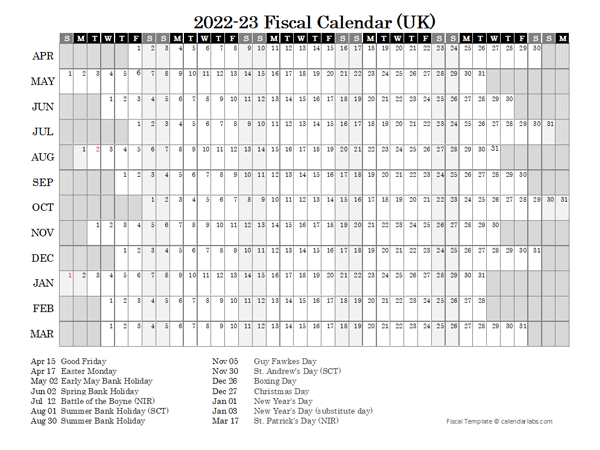

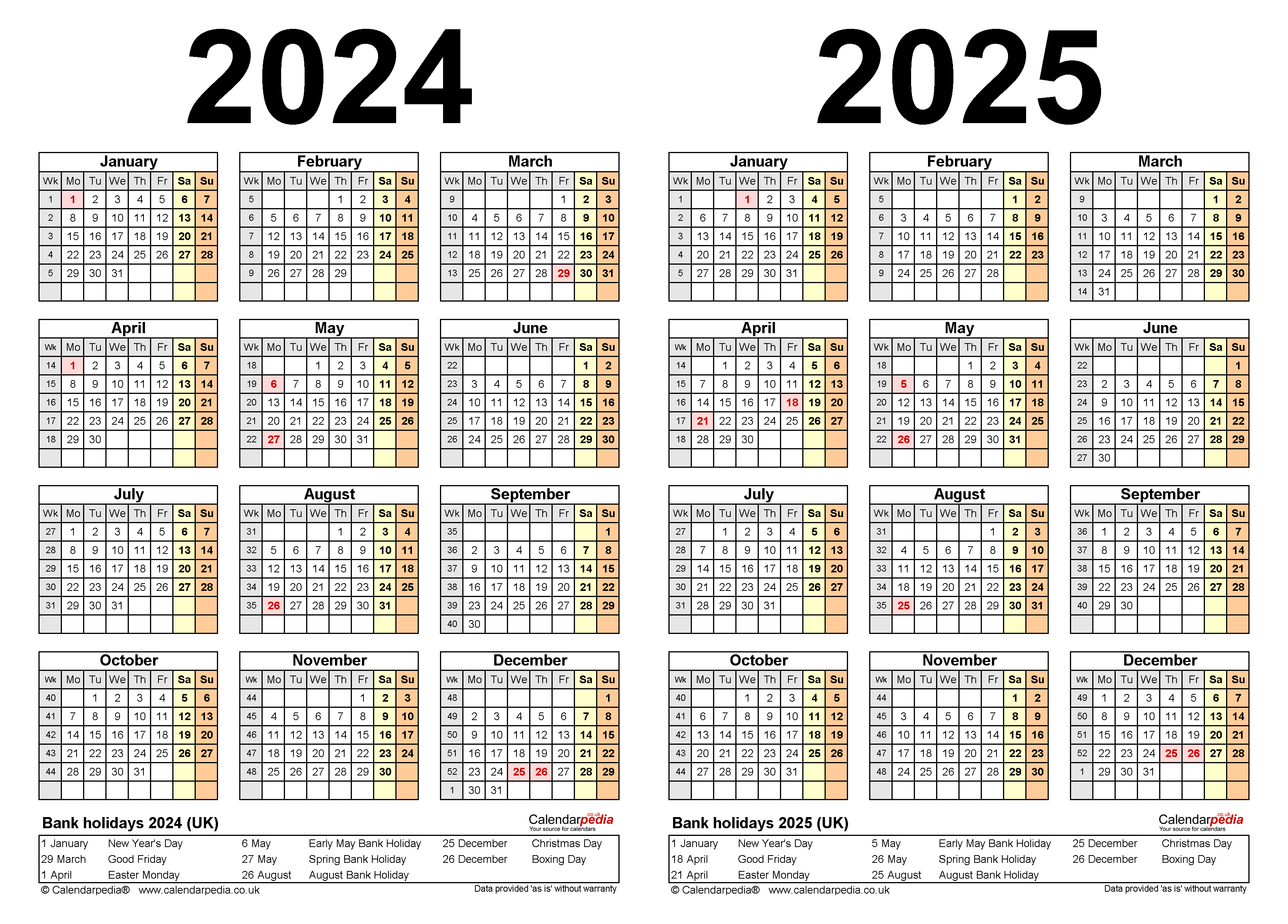

Fiscal Year Vs Calendar Year Canada 2024. Key Takeaways A fiscal year is a twelve-month period chosen by a company to report its financial information. Understanding what each involves can help you determine which to use for accounting or tax purposes. Even so, new challenges will shape the economy and labour market. Financial reports, external audits, and federal tax filings are based on a company's. Your "tax year end" or "fiscal year end" is the date on which you prepare your annual accounts. The federal government uses a fiscal year for its budget. It includes the UK public holidays and week numbers. It also has a period of twelve consecutive months.

Fiscal Year Vs Calendar Year Canada 2024. Net earnings for the second quarter of fiscal. The corporation has to file its income tax return within six months of the end of its fiscal. Your "tax year end" or "fiscal year end" is the date on which you prepare your annual accounts. Tax Years You must figure your taxable income on the basis of a tax year. Key Takeaways A fiscal year is a twelve-month period chosen by a company to report its financial information. Fiscal Year Vs Calendar Year Canada 2024.

The corporation has to file its income tax return within six months of the end of its fiscal.

A fiscal year is also known as a financial year.

Fiscal Year Vs Calendar Year Canada 2024. Financial reports, external audits, and federal tax filings are based on a company's. The federal government uses a fiscal year for its budget. A "tax year" is an annual accounting period for keeping records and reporting income and expenses. Tax Years You must figure your taxable income on the basis of a tax year. It includes the UK public holidays and week numbers.

Fiscal Year Vs Calendar Year Canada 2024.