Calendar Year Loss Ratio Vs Accident Year 2024. Suzanne Kvilhaug Investopedia / Theresa Chiechi Definition of Calendar Year Accounting Incurred Losses Calendar year accounting incurred losses is a term used to describe the losses incurred. accident year product. Accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a book of business, so that all losses associated with accidents occurring within a given calendar year and all premium earned during that same calendar year are compared. Two basic methods exist for calculating calendar year loss ratios. These are the questions examined herein. Liability lines have seen a steady upward trend in calendar-year loss ratios over the past several years, necessitating rate increases by liability underwriters. Policy Year – these terms refer to methods of organizing insurance data. While these loss ratios provide some information about results for that year, they should not be considered as measures of overall profitability. Define Accident Year Loss Ratio. shall be the amount resulting by dividing the amount of Losses Incurred by the Company for the Accident Year for which the computation is being made, by the Net Earned Premium for the corresponding Accident Year..

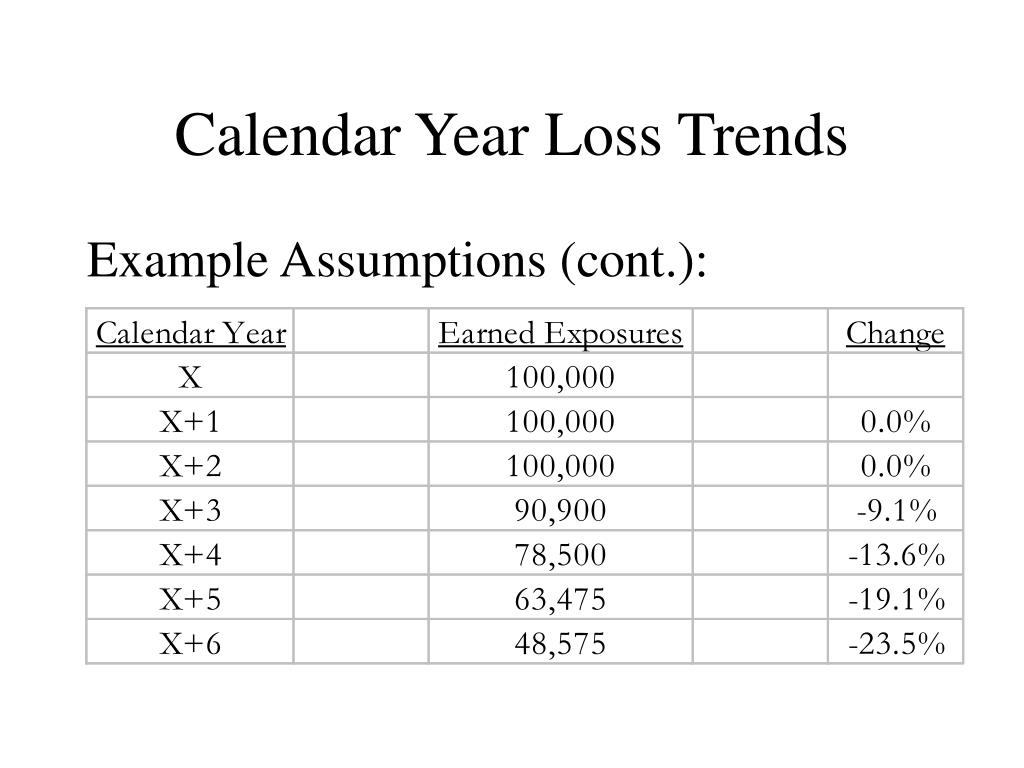

Calendar Year Loss Ratio Vs Accident Year 2024. Two basic methods exist for calculating calendar year loss ratios. Policy Year – these terms refer to methods of organizing insurance data. Liability lines have seen a steady upward trend in calendar-year loss ratios over the past several years, necessitating rate increases by liability underwriters. Calendar year data typically represents incurred losses (paid losses and changes in reserves) regardless of when the claim occurred or when the policy was. Policy year dates take the longest choose to develop. Calendar Year Loss Ratio Vs Accident Year 2024.

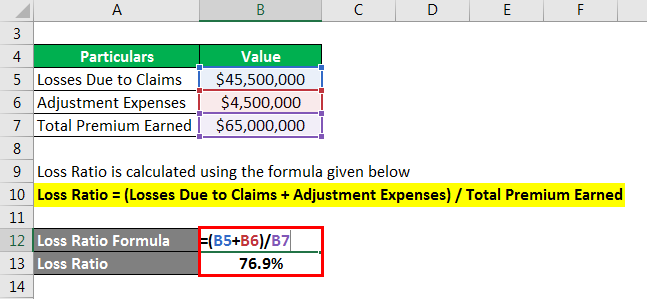

Abstract One important use of calendar year loss rations is in the determination of rate changes.

As Reported Loss and LAE ratios are net of tabular reserve discounts and gross of nontabular reserve discounts WC Net Loss and LAE Ratios— NCCI's Accident Year Selections vs.

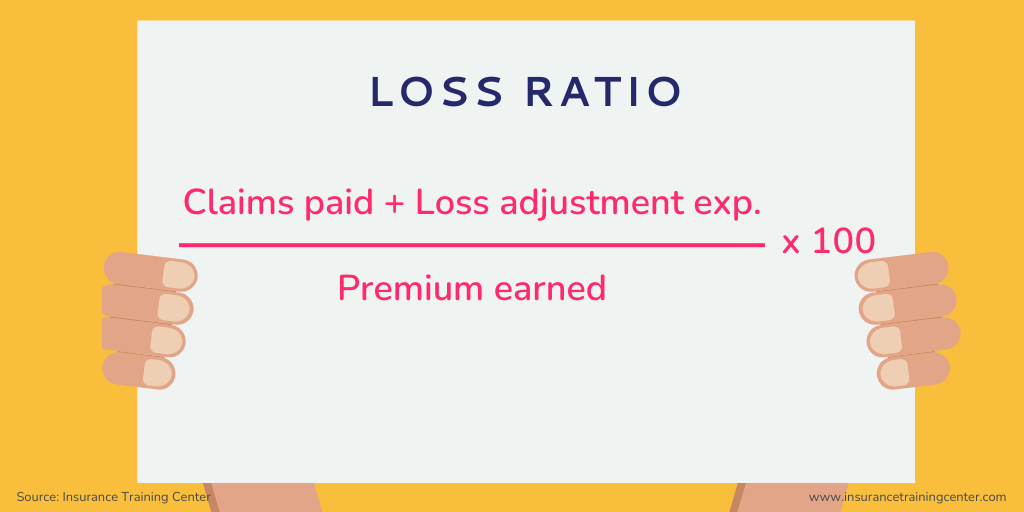

Calendar Year Loss Ratio Vs Accident Year 2024. Understanding the difference between a calendar year loss ratio and an accident year. Accident your data mention to a method away arranging loss and exposure data of an insurer or group by insurers otherwise within a order of business, so this all losses associated with accidents occurring during a presented calendar year and all option earned during that same calendar year are compared. Policy Year – these terms refer to methods of organizing insurance data. Define Accident Year Loss Ratio. shall be the amount resulting by dividing the amount of Losses Incurred by the Company for the Accident Year for which the computation is being made, by the Net Earned Premium for the corresponding Accident Year.. While these loss ratios provide some information about results for that year, they should not be considered as measures of overall profitability.

Calendar Year Loss Ratio Vs Accident Year 2024.