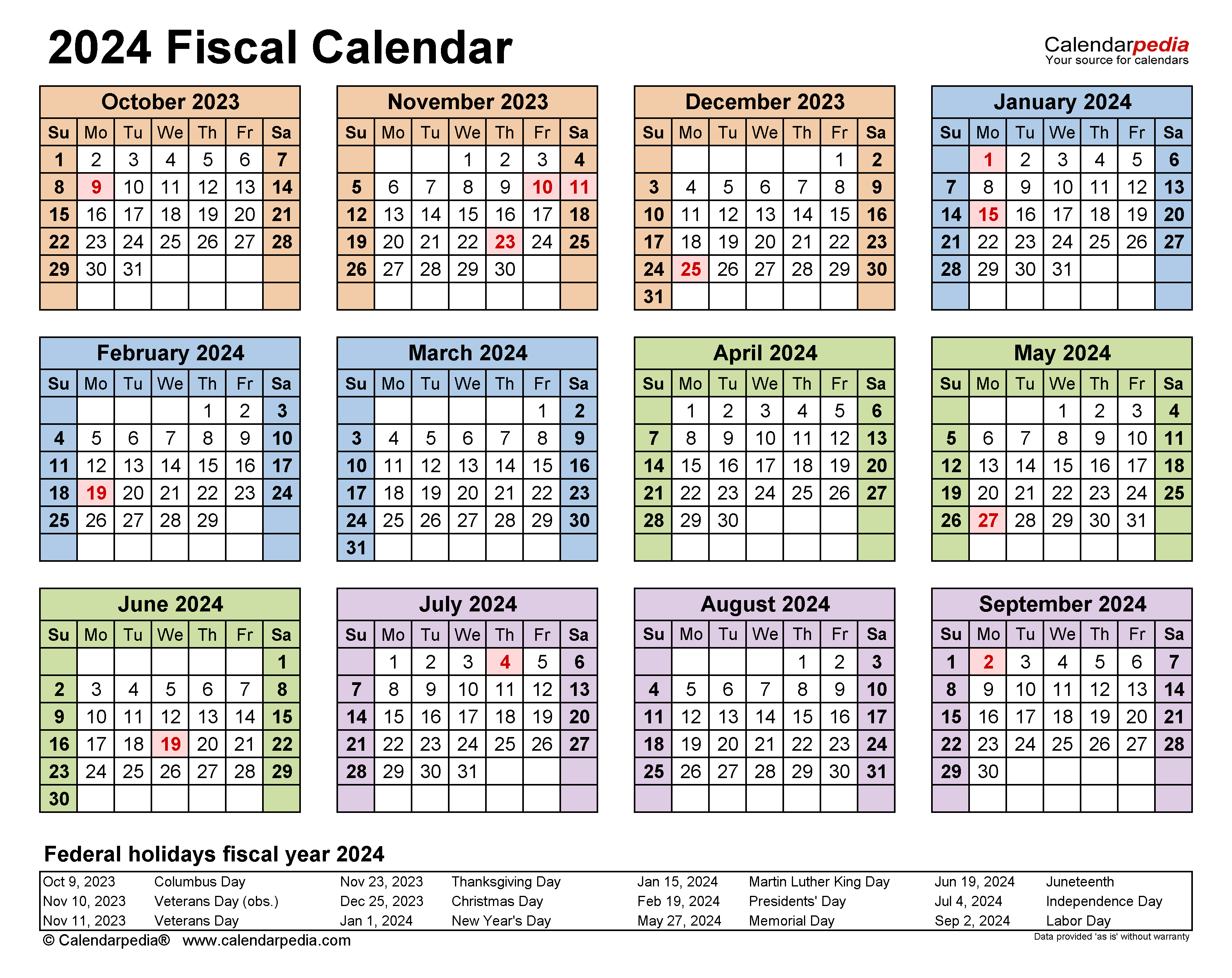

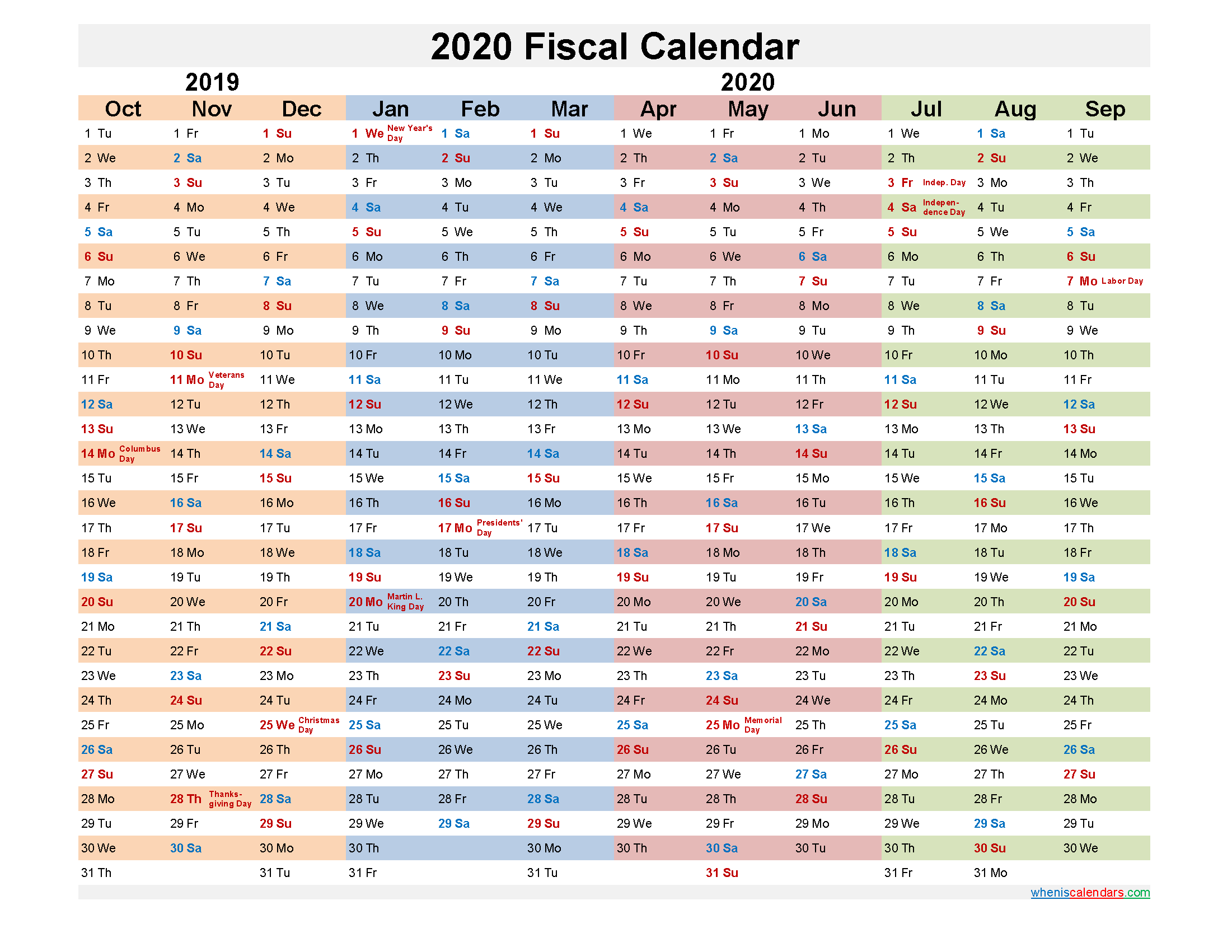

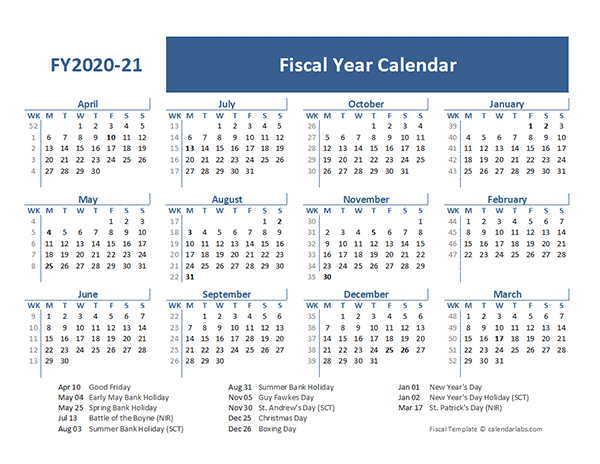

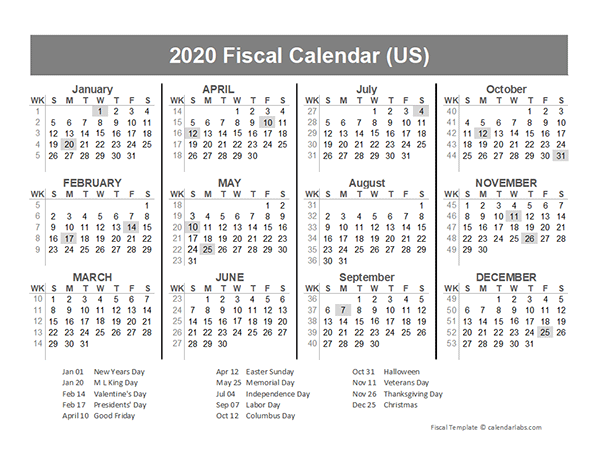

Fiscal Year Vs Calendar Year Pros And Cons 2024. The SEC rules provide two acceptable methods for adopting a change in fiscal year-end: a prospective ("stub period") or retrospective ("recast") approach. An annual accounting period does not include a short tax year. A "tax year" is an annual accounting period for keeping records and reporting income and expenses. It can also fall on a repeating date such as the last Friday in February. A fiscal year is a one-year period that companies and governments use for financial reporting and budgeting. It also has a period of twelve consecutive months. Understanding what each involves can help you determine which to use for accounting or tax purposes. Suzanne Kvilhaug Investopedia / Julie Bang What Is a Fiscal Year (FY)?

Fiscal Year Vs Calendar Year Pros And Cons 2024. Pros Allows the church to use the end of year gifts into the next year. Moves the budget process to the spring instead of the summer and early fall. Learn about the federal government's budget process, from the president's budget plan to Congress's work creating funding bills for the president to sign. The SEC rules provide two acceptable methods for adopting a change in fiscal year-end: a prospective ("stub period") or retrospective ("recast") approach. Doing this makes it easier for HR to keep track of account balances, carry over, annual accrual increases, etc. Fiscal Year Vs Calendar Year Pros And Cons 2024.

An annual accounting period does not include a short tax year.

Congress begins work on a federal budget for the next fiscal year.

Fiscal Year Vs Calendar Year Pros And Cons 2024. Vikki Velasquez What Is a Calendar Year? CBMs: Data used for claims -based measures are not usually. from a single calendar year. Manually having to keep track of so many things for every employee makes it simpler to consolidate. It can also fall on a repeating date such as the last Friday in February. Pros Allows the church to use the end of year gifts into the next year.

Fiscal Year Vs Calendar Year Pros And Cons 2024.