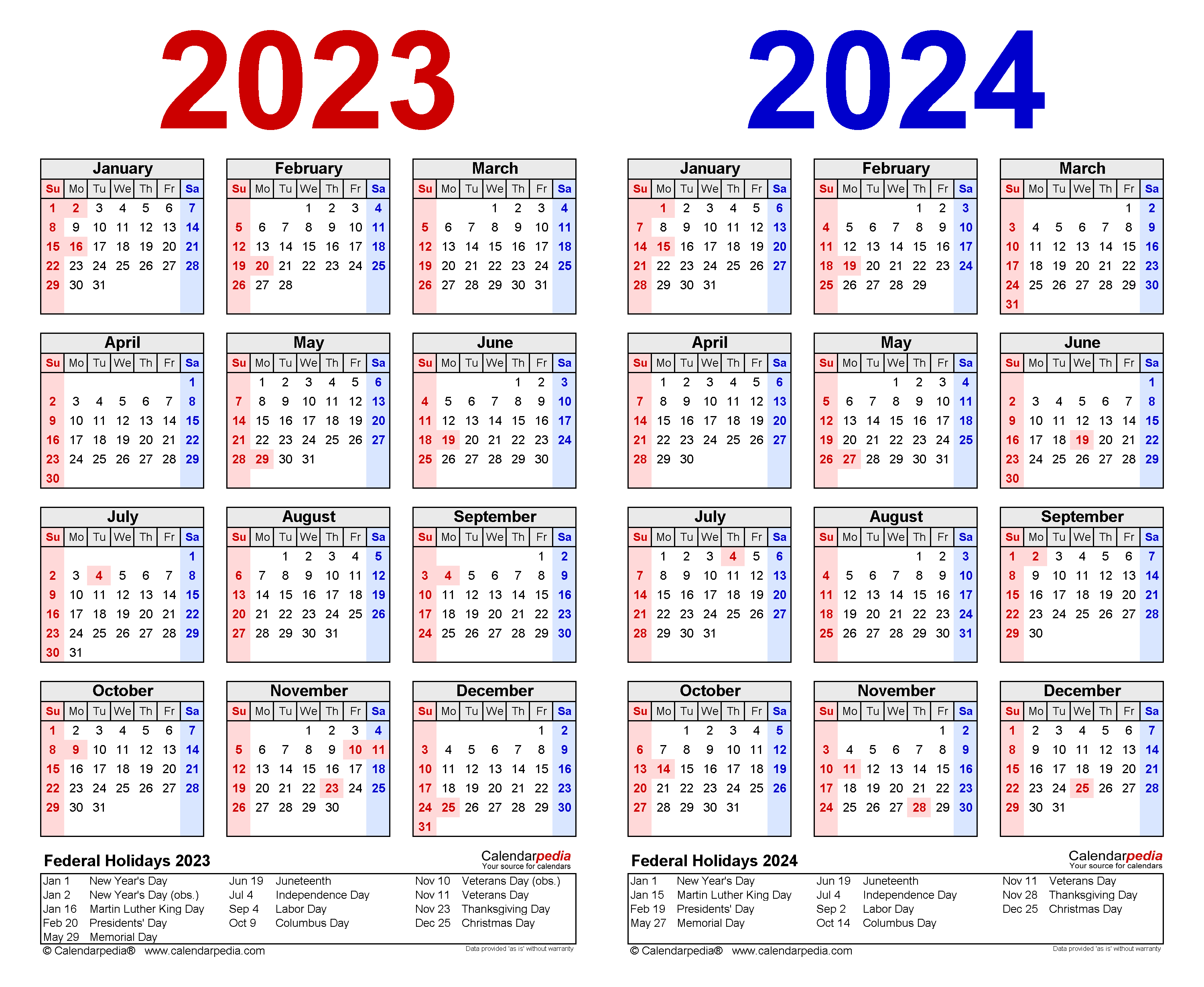

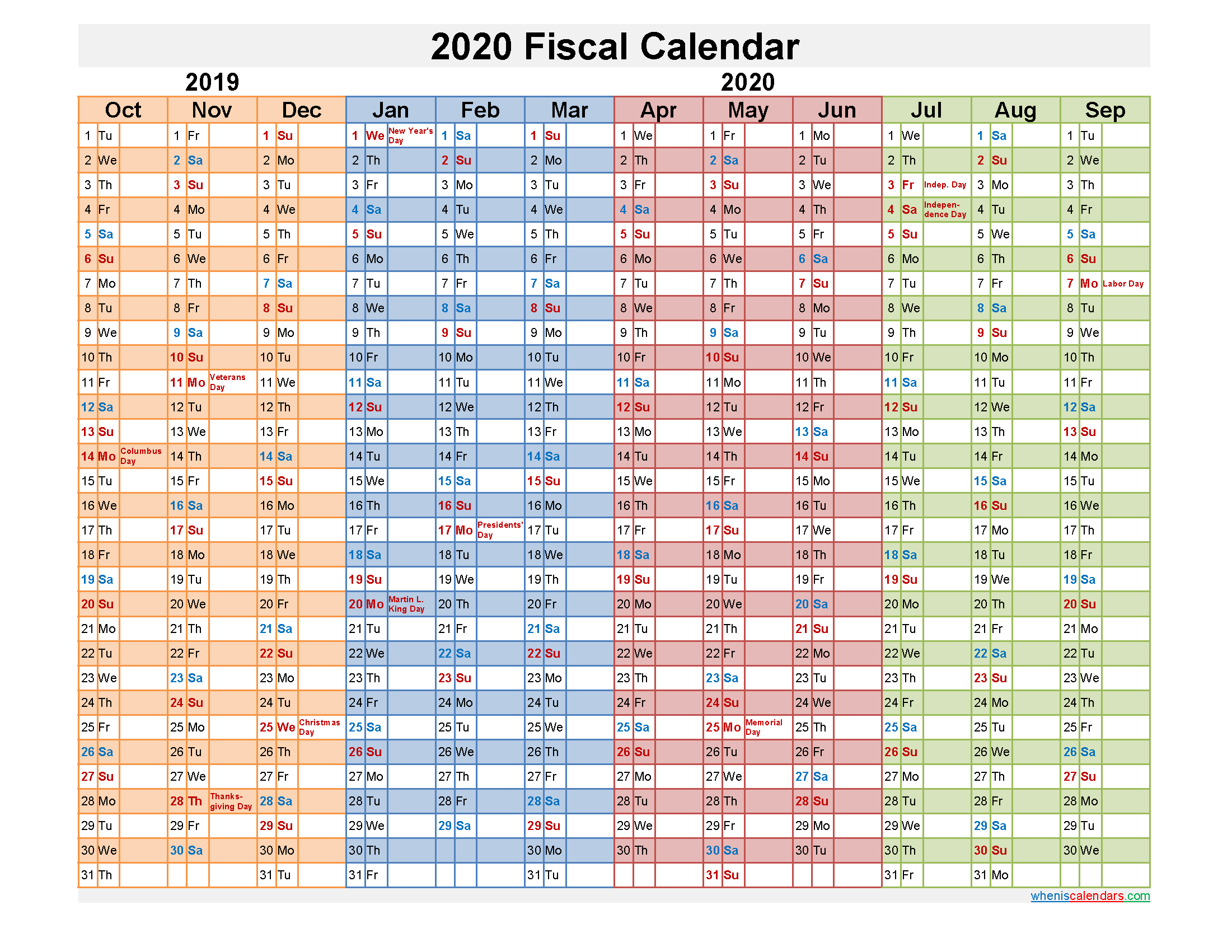

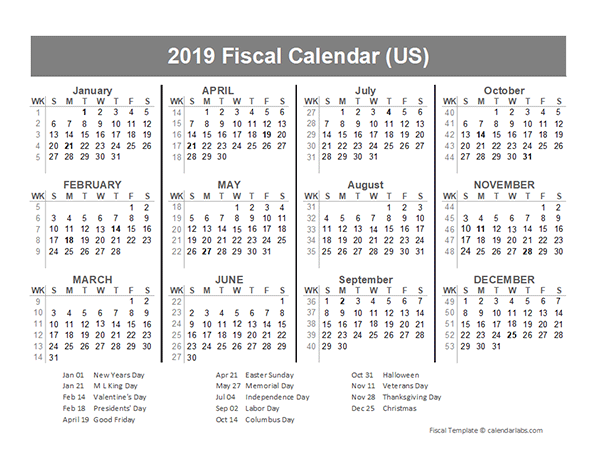

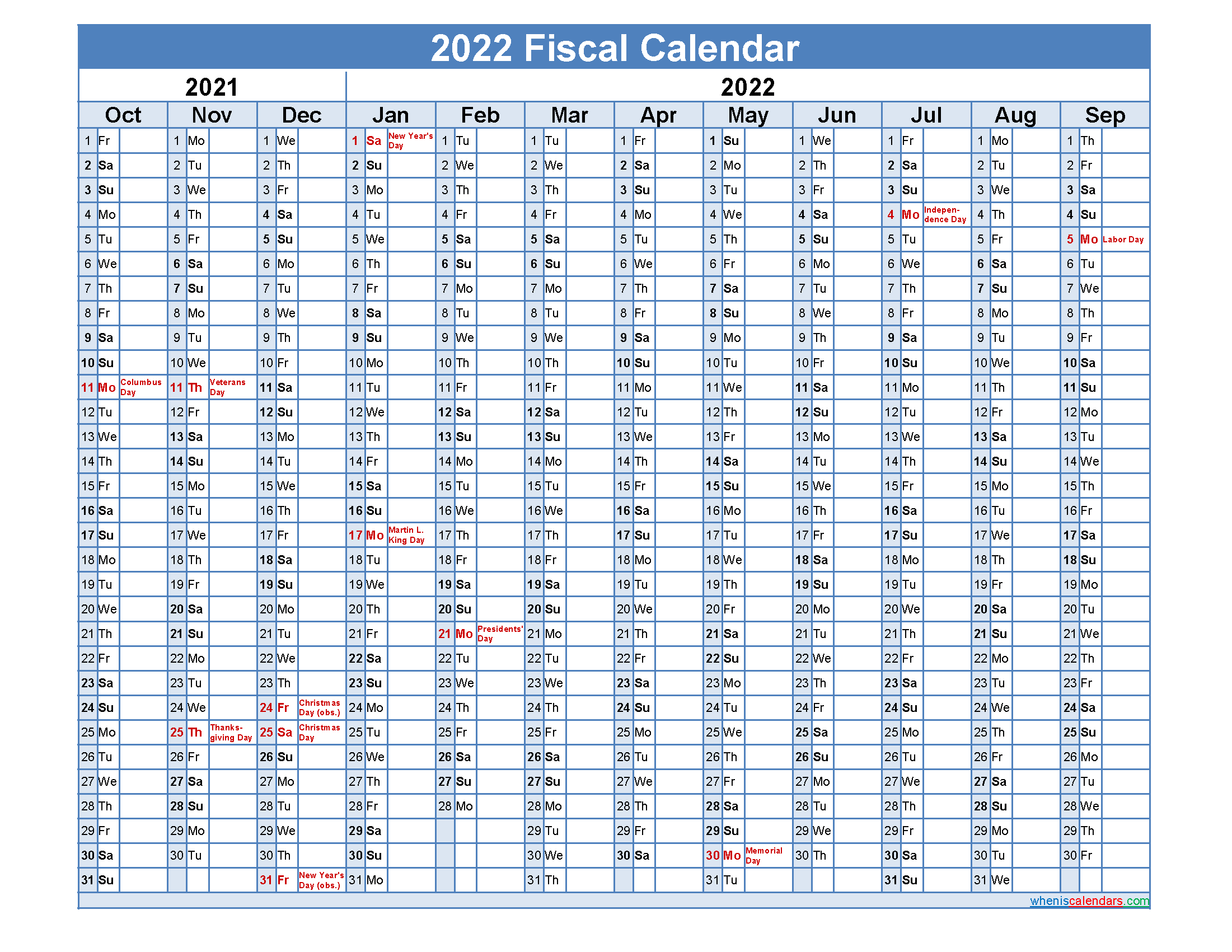

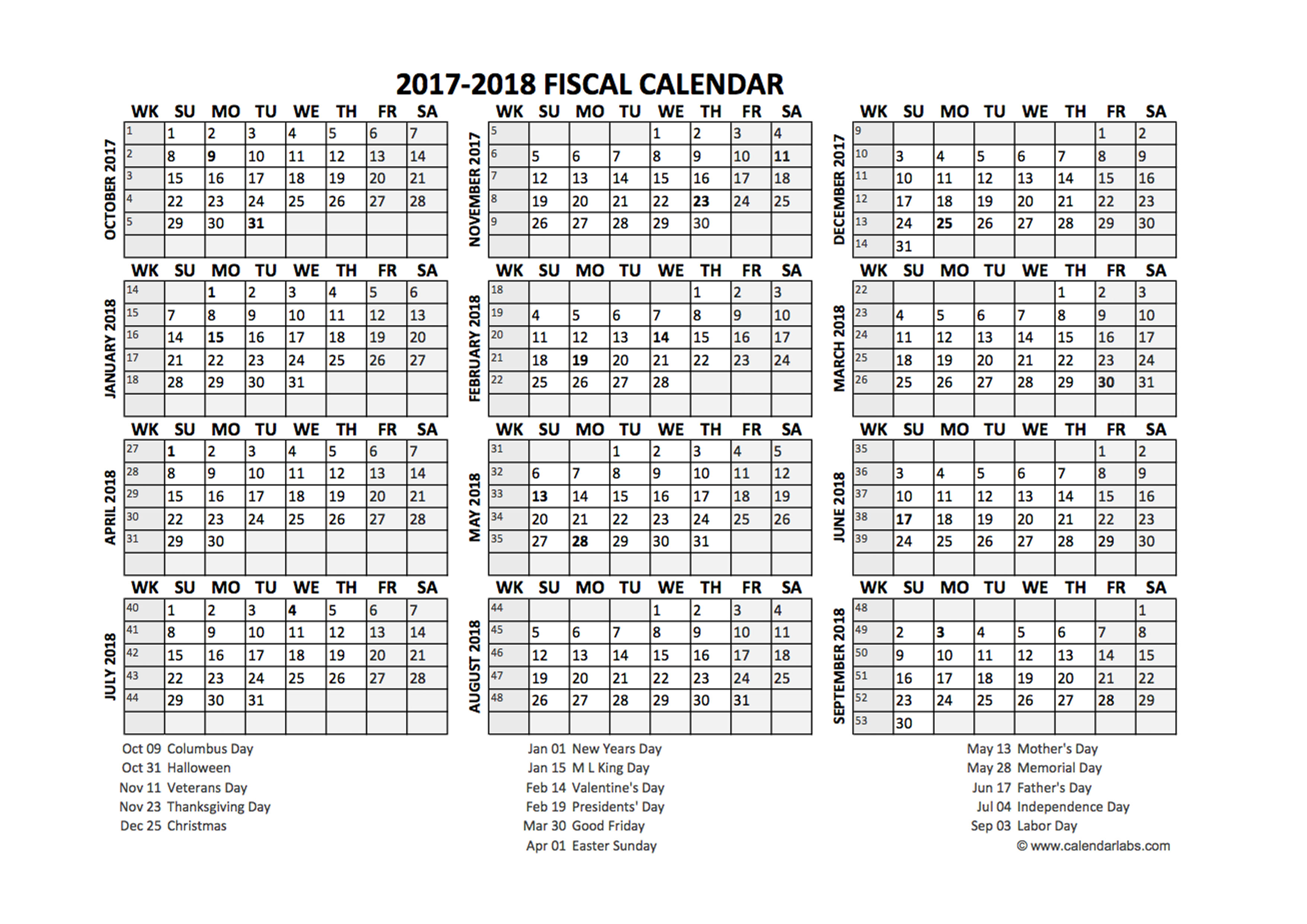

Calendar Year Vs Fiscal Year Tax Filer 2024. The tax year can end at different times depending on how a business files taxes. US edition with federal holidays and observances. The challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. S. government runs on a different financial schedule than the rest of us. Understanding what each involves can help you determine which to use for accounting or tax purposes. Calendar Year: When do I file? A "tax year" is an annual accounting period for keeping records and reporting income and expenses. CBMs: Data used for claims -based measures are not usually. from a single calendar year.

Calendar Year Vs Fiscal Year Tax Filer 2024. View due dates and actions for each month. Fiscal years that vary from a calendar. S. government runs on a different financial schedule than the rest of us. CBMs: Data used for claims -based measures are not usually. from a single calendar year. The challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. Calendar Year Vs Fiscal Year Tax Filer 2024.

When will the IRS accept returns?

So, what is a fiscal year?

Calendar Year Vs Fiscal Year Tax Filer 2024. Well, it can get more complicated than that when you're talking about money and taxes. Visit this page on your Smartphone or tablet, so you can view the Online Tax Calendar on your mobile device. The dates in this calendar apply whether you use a fiscal year or the calendar year as your tax year. It also has a period of twelve consecutive months. An annual accounting period does not include a short tax year.

Calendar Year Vs Fiscal Year Tax Filer 2024.