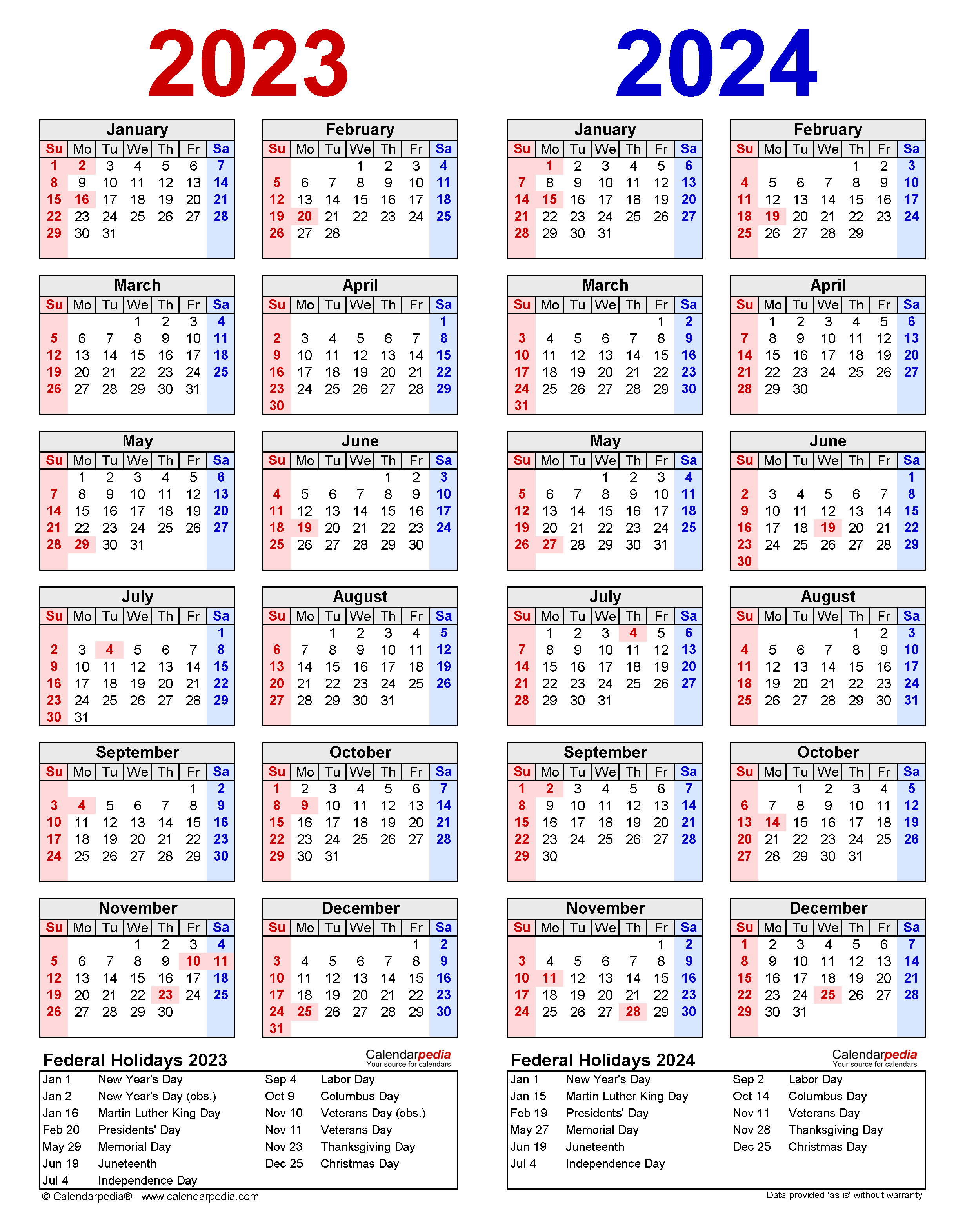

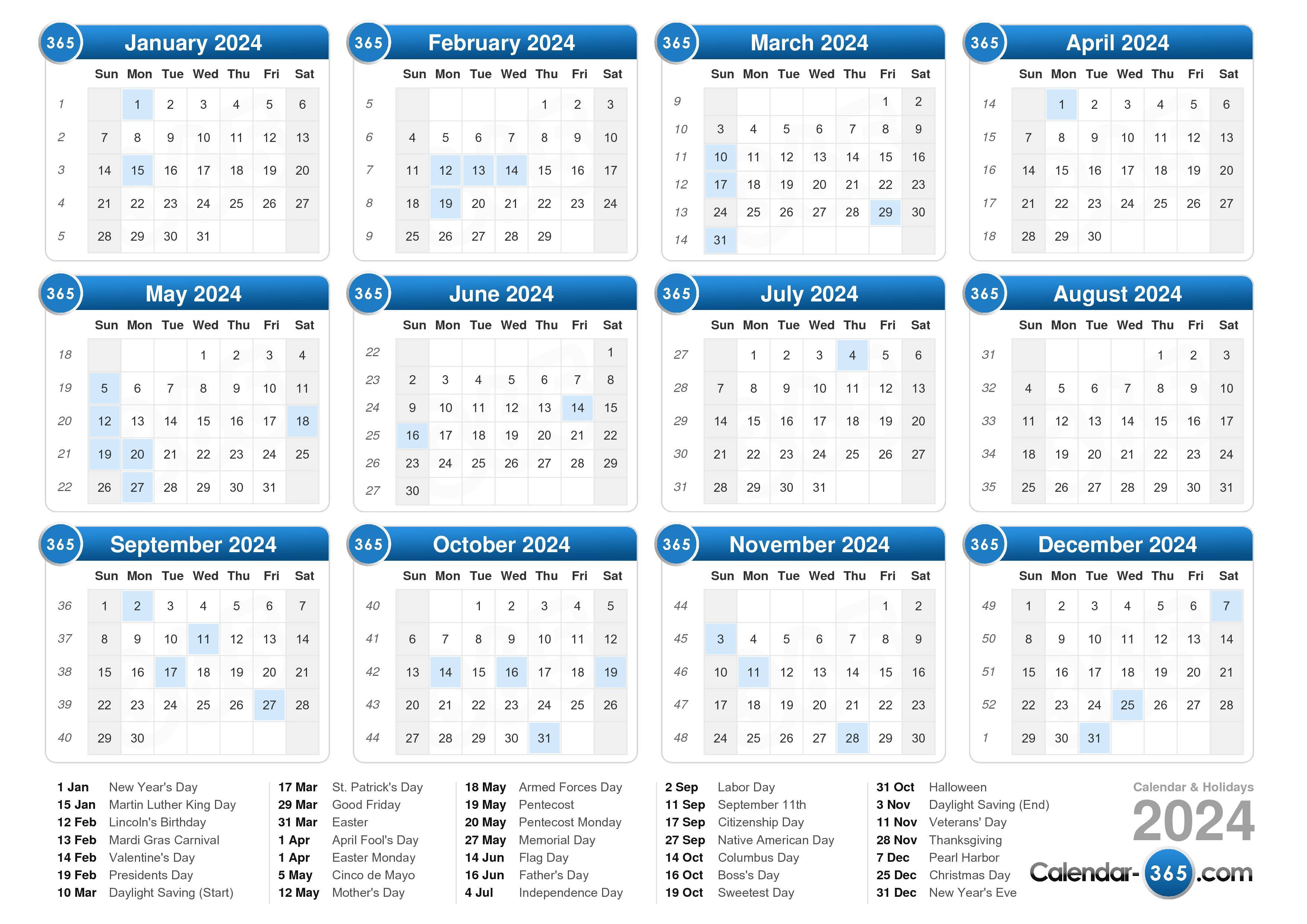

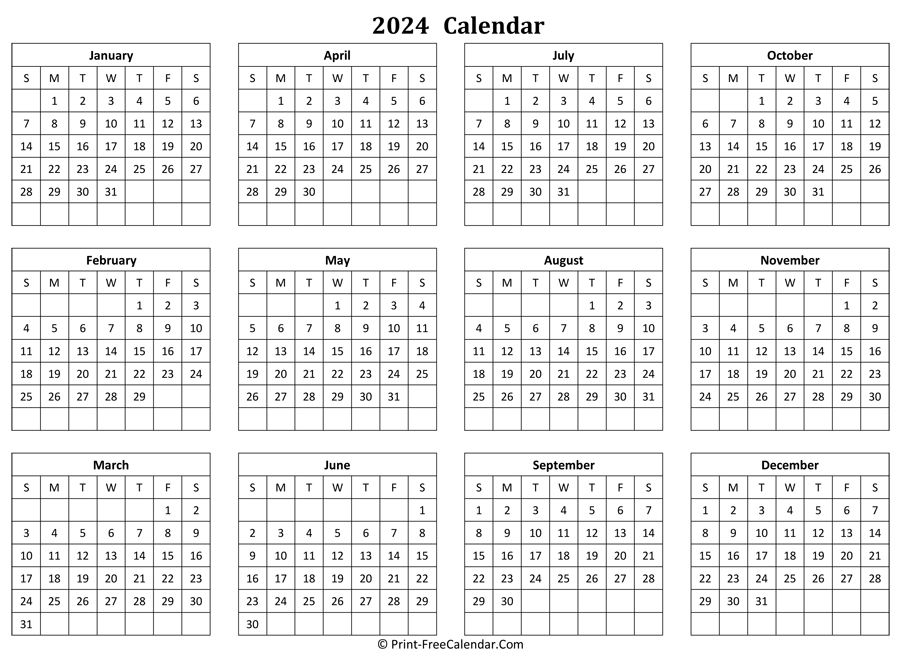

Calendar Year Deductible 2024. Not all services are subject to the deductible.. The new limits are summarized in the table below. The Advance Notice is released on an annual basis and includes proposed updates to the capitation and risk adjustment methodologies used to calculate payments. Background on the Physician Fee Schedule The IRS today released an advance version of Rev. One-hundred-year flood means a flood having a one per cent chance of being equaled or exceeded in any given year. The Part A deductible must be met per benefit period, not per calendar year. The first Distribution Calendar Year is the calendar year immediately preceding the calendar year that contains the Participant's Required. Previous: ← Business income (without extra expense) coverage form.

Calendar Year Deductible 2024. Related to Calendar Year Deductible Individual. The Part A deductible must be met per benefit period, not per calendar year. One-hundred-year flood means a flood having a one per cent chance of being equaled or exceeded in any given year. Calendar-year deductible is an amount payable by an insured during a calendar year before a group or individual health insurance policy begins to pay for medical expenses. Background on the Physician Fee Schedule The IRS today released an advance version of Rev. Calendar Year Deductible 2024.

The new limits are summarized in the table below.

Previous: ← Business income (without extra expense) coverage form.

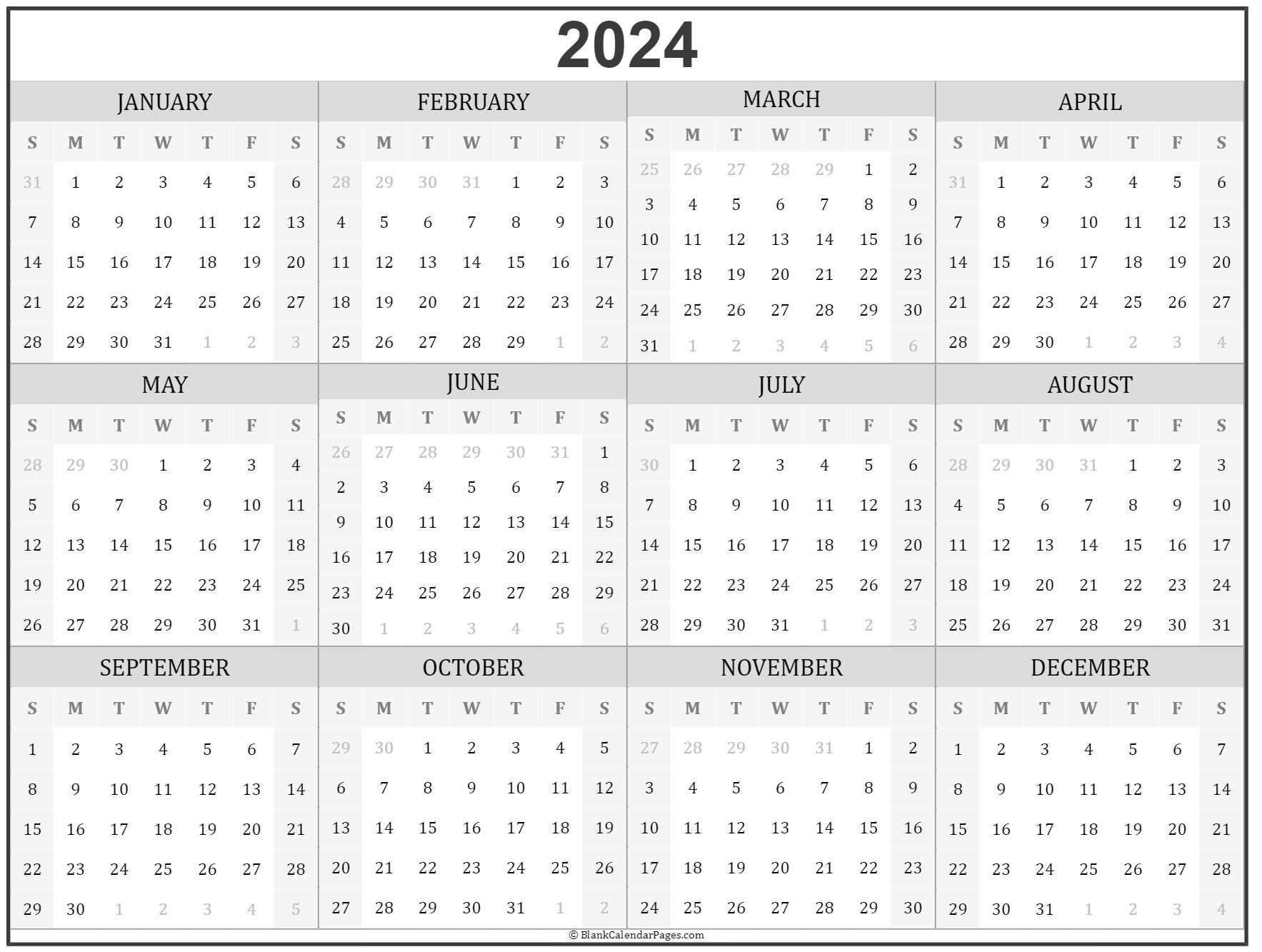

Calendar Year Deductible 2024. Calendar-year deductible is an amount payable by an insured during a calendar year before a group or individual health insurance policy begins to pay for medical expenses. We've highlighted some noteworthy "holidates," like Financial Literacy Month, Global Entrepreneurship Week, and Mental Health Awareness Month, along with a free corresponding EVERFI lesson for each. Download and print your calendar so that your students get the skills. ADR is a widely accepted lodging industry measure derived from a property's room rental revenue divided by the number of rooms rented. Elective Deferrals means any Employer contributions made to the Plan at the election of a participating Employee, in.

Calendar Year Deductible 2024.