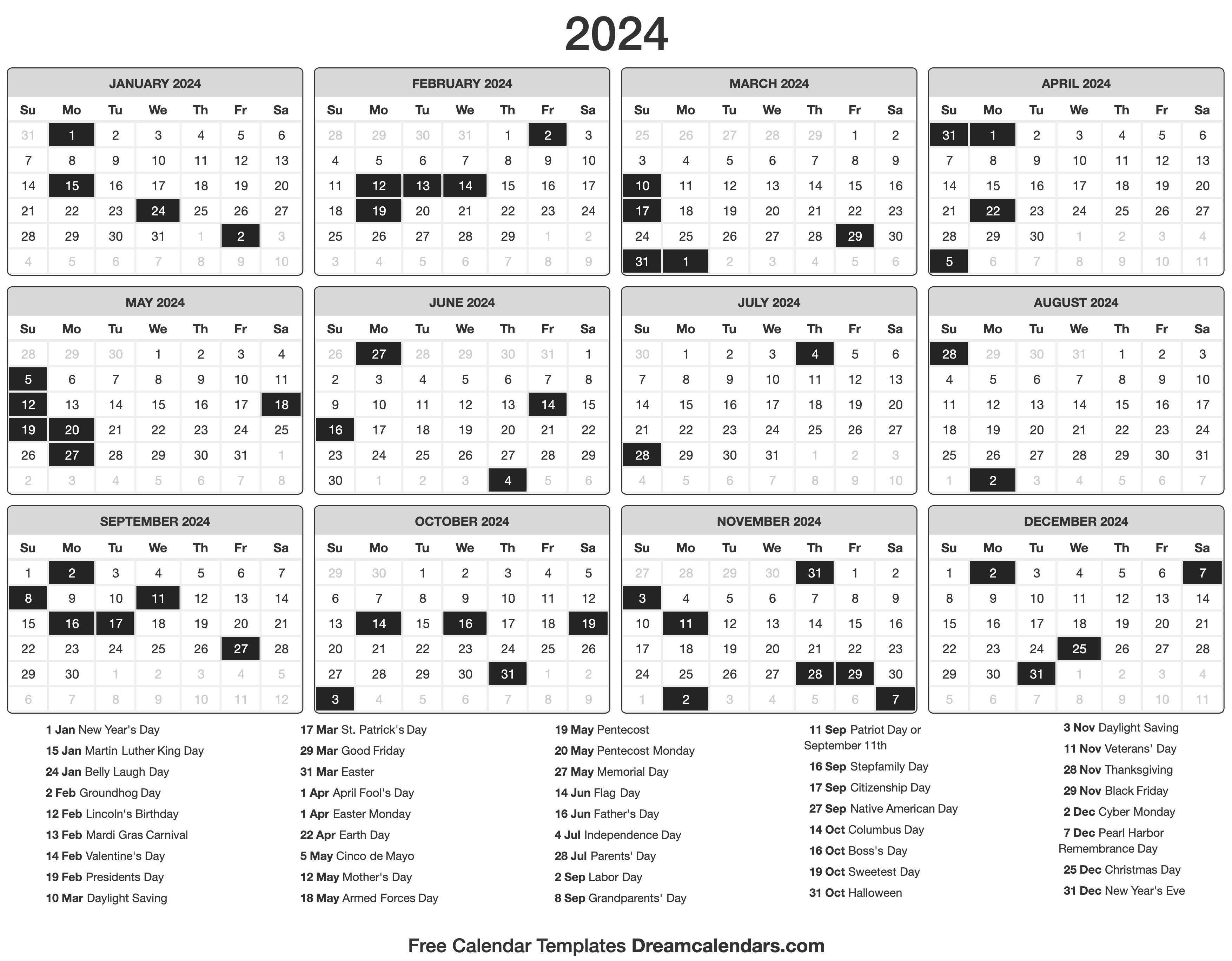

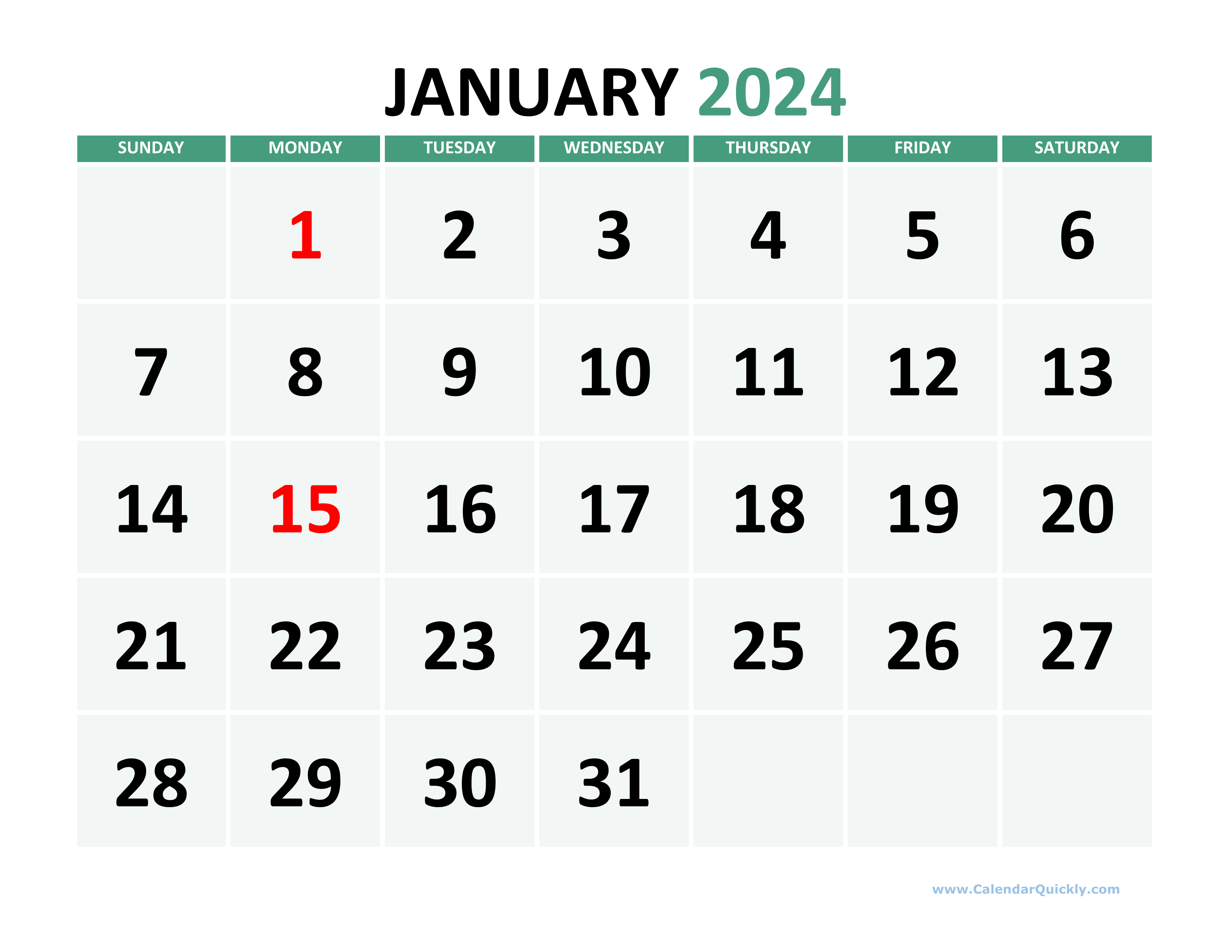

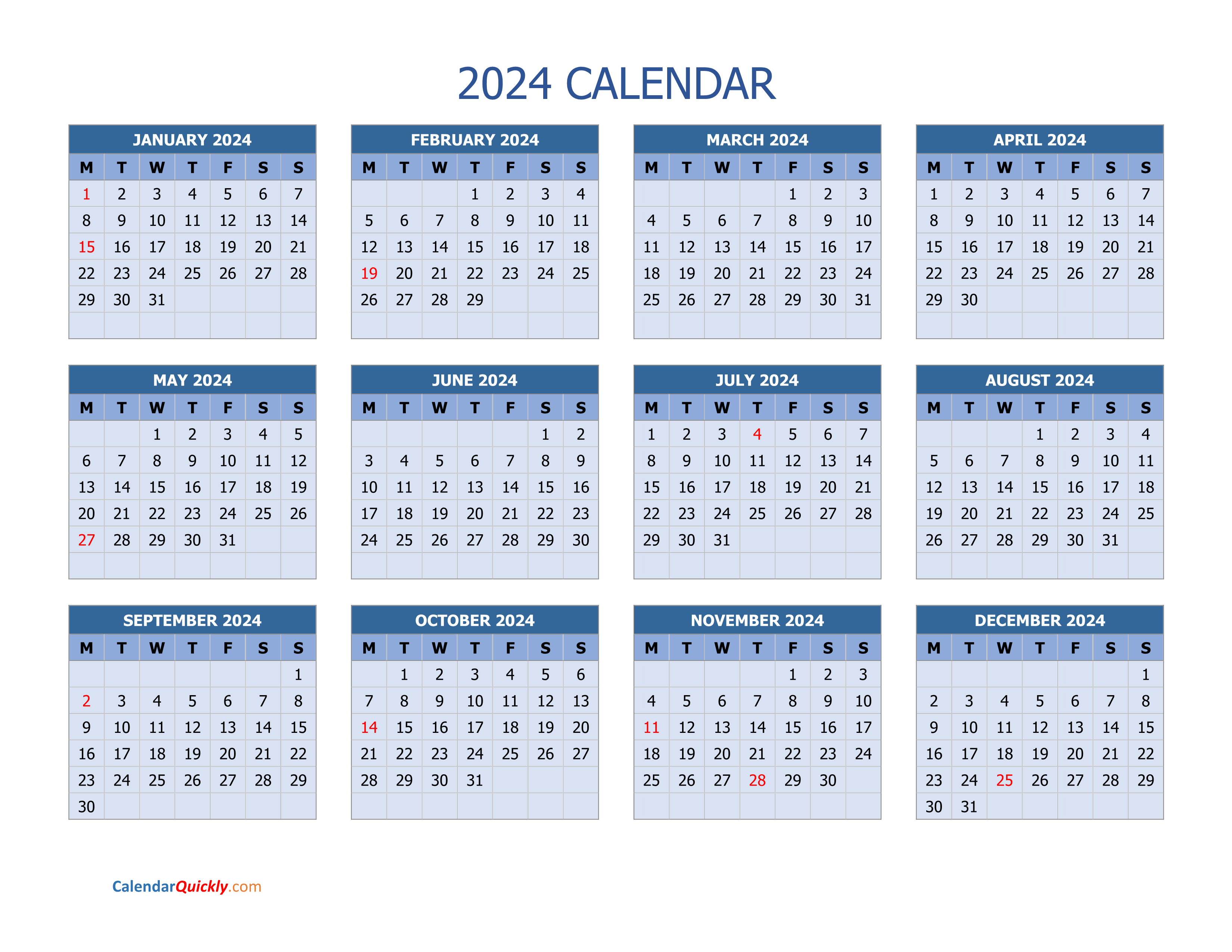

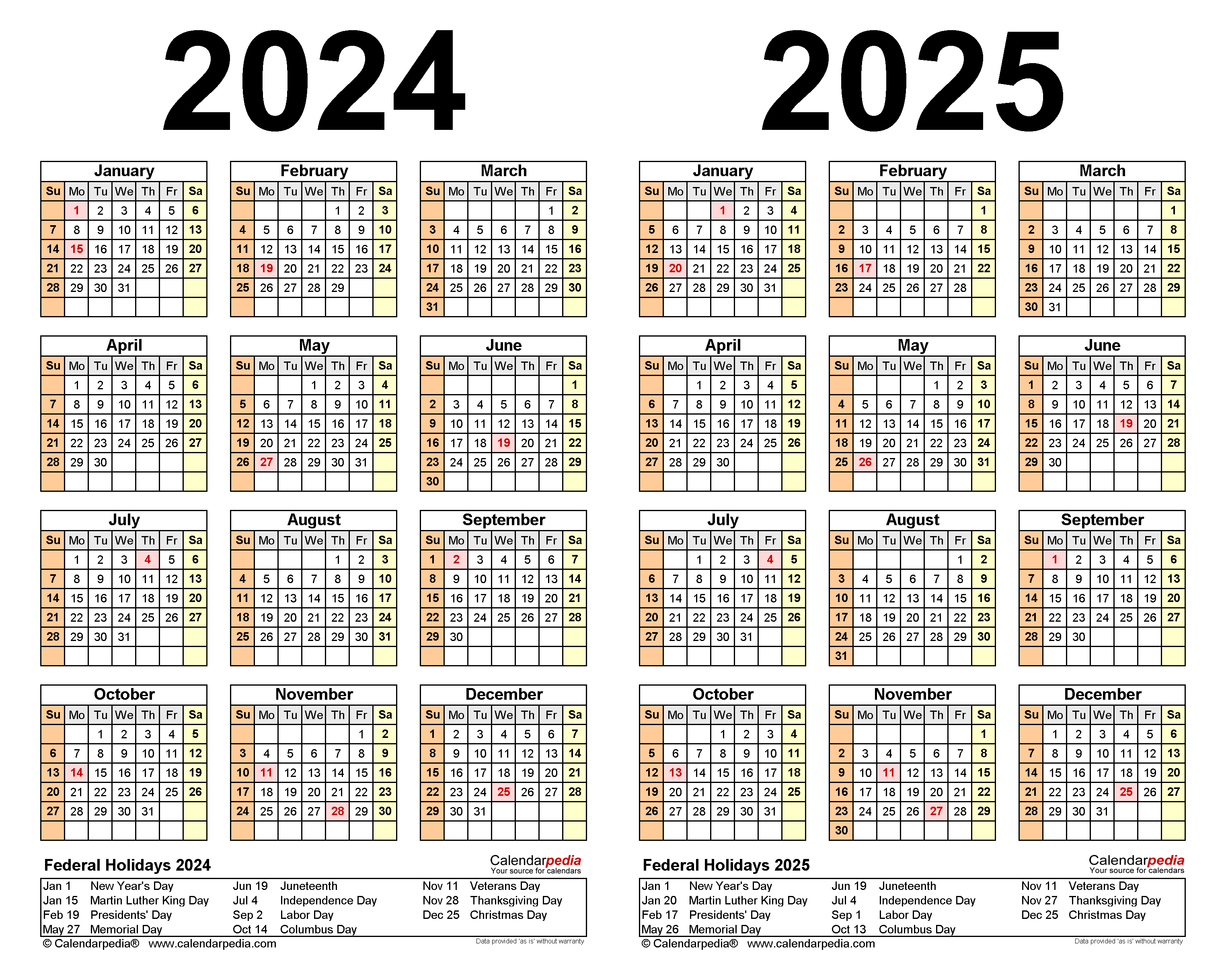

Calendar Year Means In Accounting 2024. Downloadable calendars for fiscal and calendar year pay schedules. The calendar year is the basis for numerous tax filings. The accounting period for individual taxpayer is always on the basis of the calendar year; whereas, non-individual (corporate) taxpayer has the option to adopt a fiscal year or calendar year of accounting period. S. corporation has a non-calendar accounting year, it is referred to as a fiscal year. A fiscal year is a twelve-month period chosen by a company to report its financial information. Set the fiscal year (FY) to start with the current calendar year (CY). An annual accounting period does not include a short tax year. Fiscal and Calendar Year Pay Calendars.

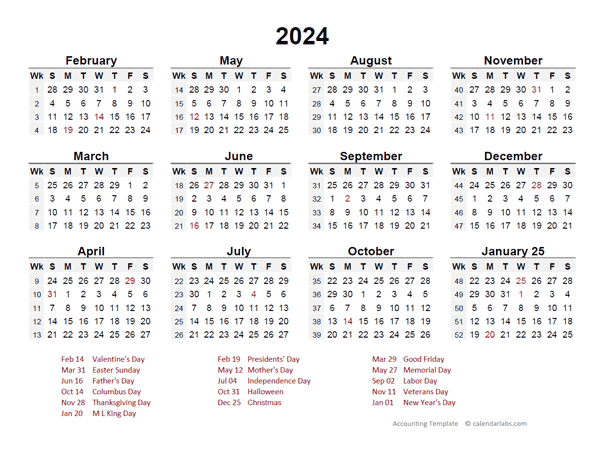

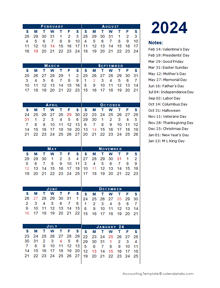

Calendar Year Means In Accounting 2024. Financial reports, external audits, and federal tax filings are based on a company's fiscal year. Each fiscal year quarter is color-coded in a different color. A "tax year" is an annual accounting period for keeping records and reporting income and expenses. Set the fiscal year (FY) to start with the current calendar year (CY). S. corporation has a non-calendar accounting year, it is referred to as a fiscal year. Calendar Year Means In Accounting 2024.

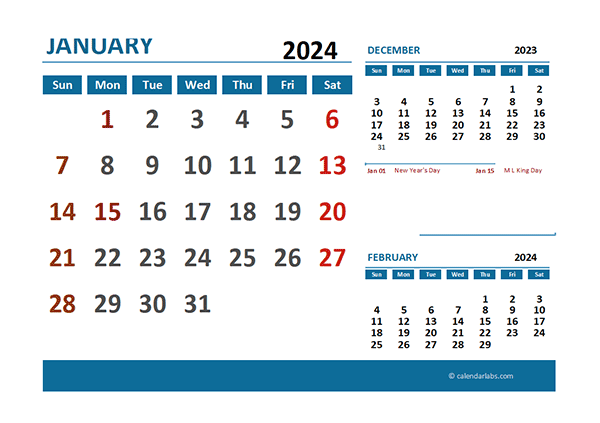

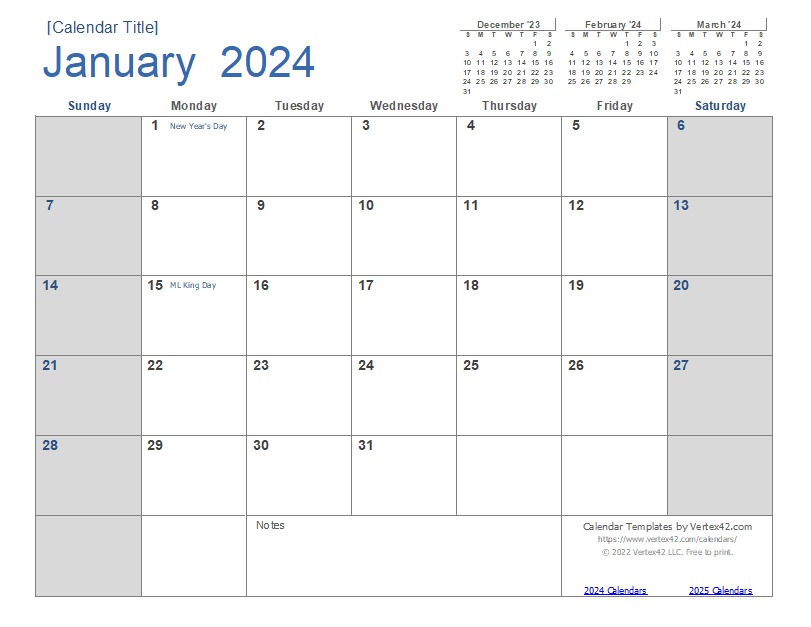

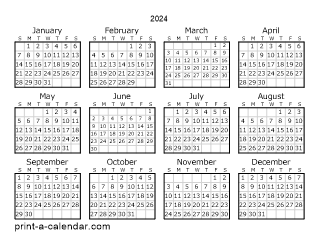

Fiscal and Calendar Year Pay Calendars.

Some holidays and dates are color-coded: Red -Federal Holidays and Sundays.

Calendar Year Means In Accounting 2024. For individual and corporate taxation purposes, the. Downloadable calendars for fiscal and calendar year pay schedules. Each fiscal year quarter is color-coded in a different color. It tends to be the default fiscal year for entities that have not specifically established a different date range for their fiscal years. The accounting period for individual taxpayer is always on the basis of the calendar year; whereas, non-individual (corporate) taxpayer has the option to adopt a fiscal year or calendar year of accounting period.

Calendar Year Means In Accounting 2024.