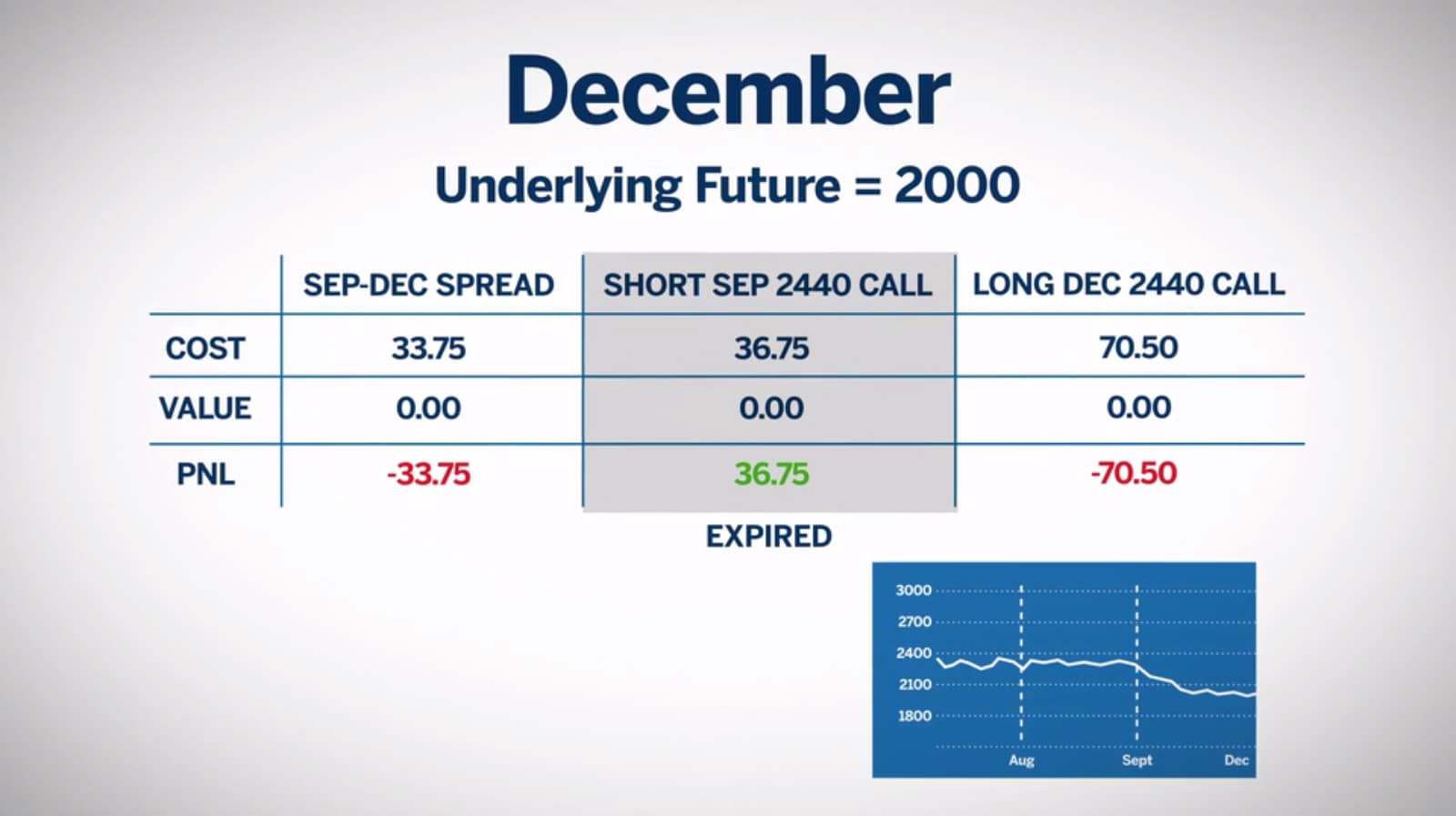

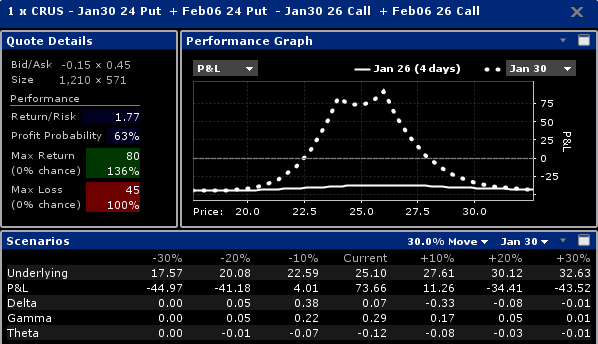

Calendar Option Strategy Before Earnings 2024. This strategy is ideal for a trader whose. Earnings are when a publicly traded company announces their financial results for a set period of time. When you sell options before earnings (through calendar or Iron Condor), you want the stock to stay relatively close to the current price. A long straddle is an options strategy that involves buying both a call and a put on the same stock with the same strike price and expiration date. Calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option during the life of that option. You can see that after the holidays—traditionally a low-volatility. The idea behind a straddle is to profit from a big move in either direction. Potential goals To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Calendar Option Strategy Before Earnings 2024. Covered calls provide downside protection only to the extent of the premium received. In this scenario, the premium from that short option bleeds off and funnels straight into the trader's wallet. Calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option during the life of that option. However, recent research conducted by tastytrade suggests that post-earnings implied volatility may not be as "cheap" as many think. The idea behind a straddle is to profit from a big move in either direction. Calendar Option Strategy Before Earnings 2024.

Please read the options disclosure document titled "Characteristics and Risks of Standardized Options." Supporting documentation for any claims or statistical information is available upon request.

Potential goals To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Calendar Option Strategy Before Earnings 2024. When you sell options before earnings (through calendar or Iron Condor), you want the stock to stay relatively close to the current price. A calendar spread is a derivatives strategy that involves buying a longer-dated contract to sell a shorter-dated contract. In a nutshell, the calendar spread strategy allows traders to buy a longer-dated contract and sell a shorted-dated one, allowing them to create a trade that minimizes the effects of time versus holding a long option ( call/put) only. Use our free tools to compare the current expected move to past earnings moves to help decide whether to trade or fade the move. The term "earnings crush" refers to the tendency of implied volatility to crash after an earnings announcement, particularly in the expiration month capturing the "event.".

Calendar Option Strategy Before Earnings 2024.