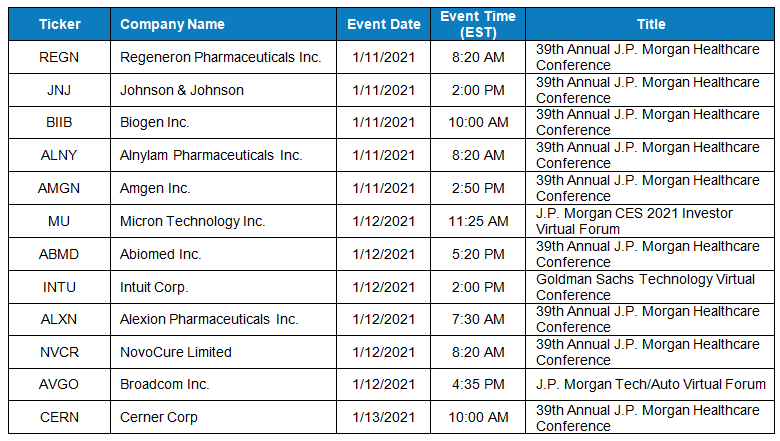

Example Of Earnings Calendar Options Trading 2024. The idea behind a straddle is to profit from a big move in either direction. The earnings calendar shows when each company will reveal quarterly profits. Sales, expenses, net income, and earnings per share are all included. For example, if you expect that there will be a positive price move after an earnings report, you could buy call options. Option positions to trade earnings can be based on two general. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. Use our free tools to compare the current expected move to past earnings moves to help decide whether to trade or fade the move. Know your options Calendar Spread: A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying asset but with different delivery months.

Example Of Earnings Calendar Options Trading 2024. The idea behind a straddle is to profit from a big move in either direction. Option positions to trade earnings can be based on two general. Learn when companies announce their quarterly and annual earnings, along with the latest EPS estimates and conference call times from Yahoo Finance. The schedule according to which various publicly-traded companies announce their earnings for a certain period such as a quarter or a year. Some investors tremble at the mention of the word options, but there. Example Of Earnings Calendar Options Trading 2024.

Alternatively, if you expect that there will be a negative price move after an earnings report, you could buy put options.

For example, if you expect that there will be a positive price move after an earnings report, you could buy call options.

Example Of Earnings Calendar Options Trading 2024. Stay up-to-date with this week's earnings announcements and filter by specific dates. An earnings calendar is the quarterly schedule and timetable laying out individual release dates of financial reports containing performance data for publicly traded corporations. Use our free tools to compare the current expected move to past earnings moves to help decide whether to trade or fade the move. However, recent research conducted by tastytrade suggests that post-earnings implied volatility may not be as "cheap" as many think. The earnings calendar organizes these announcements by date and company.

Example Of Earnings Calendar Options Trading 2024.