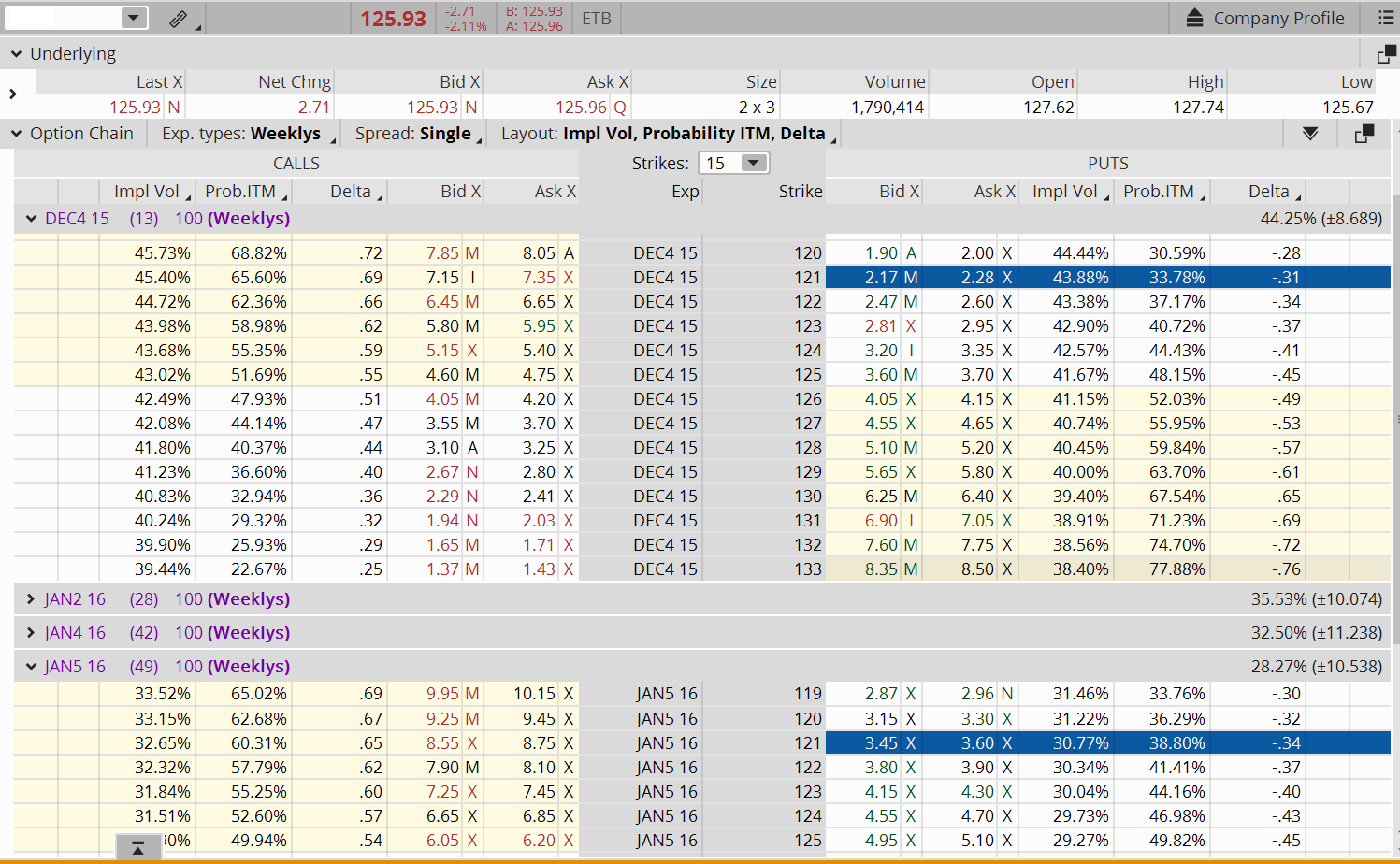

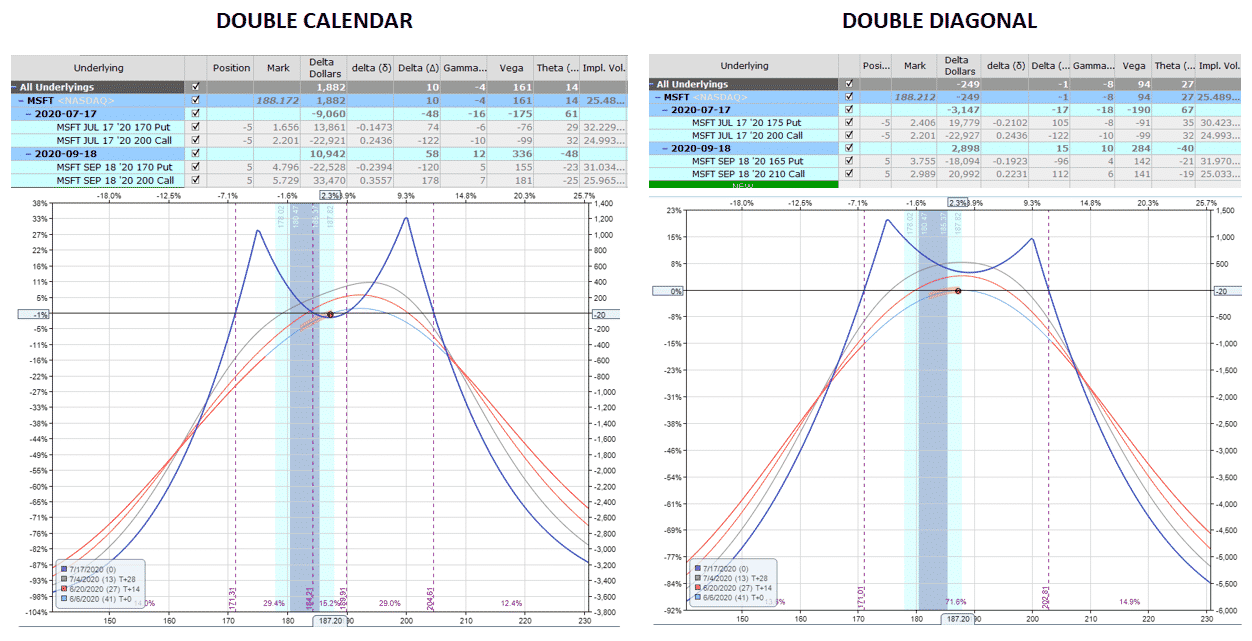

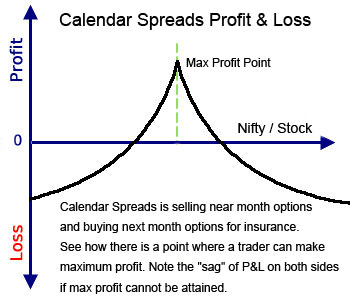

Calendar Spread Option Calculator 2024. Add stock purchase Back-month Buy or write Option: Select option Price per option*$? You can get started for free to get the latest data. Calendar Call Spread Calculator Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy. or Try an Example ($SPY) What is a calendar call spread? Let's talk about the formulas that apply at the expiration date: If sc is the short call premium received and lc is the long call premium paid, then the bull call premium spent (ps) satisfies:. ps = (sc – lc) × n; where n represents the number of spreads we acquire. Clicking on the chart icon on the Calendar Call Spread screener loads the strategy calculator with the selected calendar call. Calendar Spread Calculator shows projected profit and loss over time. Underlying stock symbol Symbol: Get price ? This type of strategy is also known as a time or horizontal spread due to the differing maturity dates.

Calendar Spread Option Calculator 2024. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Clicking on the chart icon on the Calendar Call Spread screener loads the strategy calculator with the selected calendar call. Calendar spreads can be constructed using calls or puts. Calendar Spread Calculator shows projected profit and loss over time. Calendar Spread Calculator A calendar spread involves buying long term call options and writing call options at the same strike price that expire sooner. Calendar Spread Option Calculator 2024.

A long calendar spread with calls is created by buying one "longer-term" call and selling one "shorter-term" call with the same strike price.

A calendar call spread consists of two calls with the same strike price but different expirations.

Calendar Spread Option Calculator 2024. A put calendar is another options strategy involving the sale of a short-term put contract and the purchase of another put that has a later expiration date. It is a strongly neutral strategy. A typical long calendar spread involves buying a longer-term option and selling a shorter-term option that is of the same type and exercise price. The Calendar Call Spread Calculator can be used to chart theoretical profit and loss (P&L) for a calendar call position. Underlying stock symbol Symbol: Get price ?

Calendar Spread Option Calculator 2024.