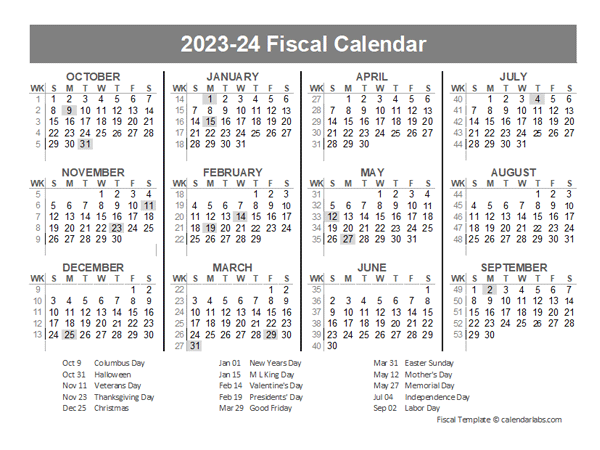

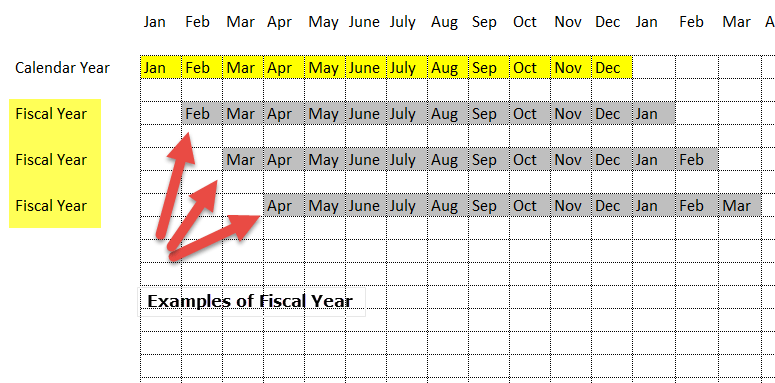

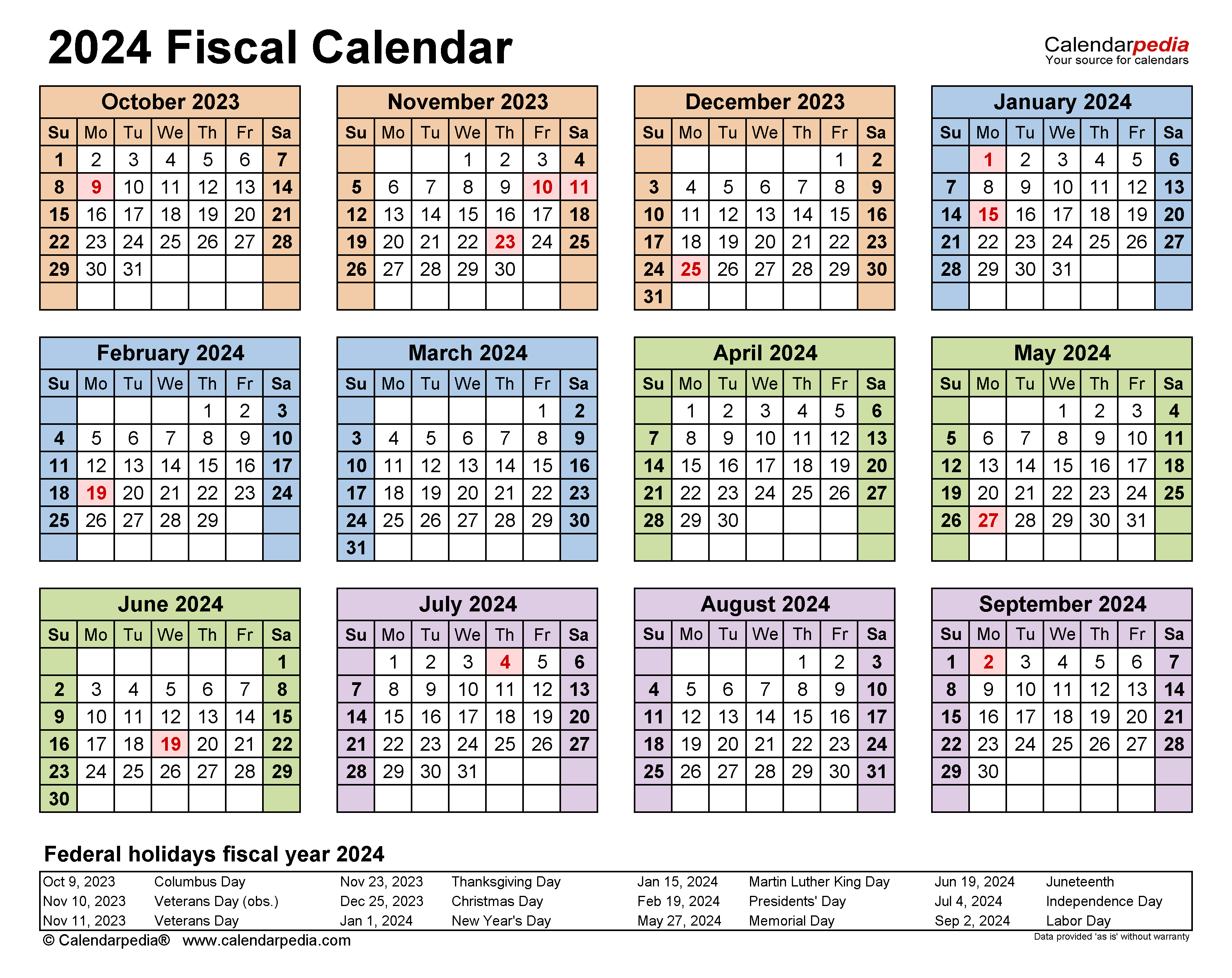

Calendar Year Vs Fiscal Year Taxes 2024. An annual accounting period does not include a short tax year. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted fiscal year. A tax year can be a calendar tax year or a fiscal tax year, but what you're probably most interested in is a tax year as it relates to your income taxes. News Career development Fiscal Year vs. S. government runs on a different financial schedule than the rest of us. Tax Years You must figure your taxable income on the basis of a tax year. The dates in this calendar apply whether you use a fiscal year or the calendar year as your tax year. When used in reference to personal income taxes, a tax.

Calendar Year Vs Fiscal Year Taxes 2024. News Career development Fiscal Year vs. US edition with federal holidays and observances. The dates of a fiscal year are determined by: The basic definitions from a single calendar year. When used in reference to personal income taxes, a tax. S. government runs on a different financial schedule than the rest of us. Calendar Year Vs Fiscal Year Taxes 2024.

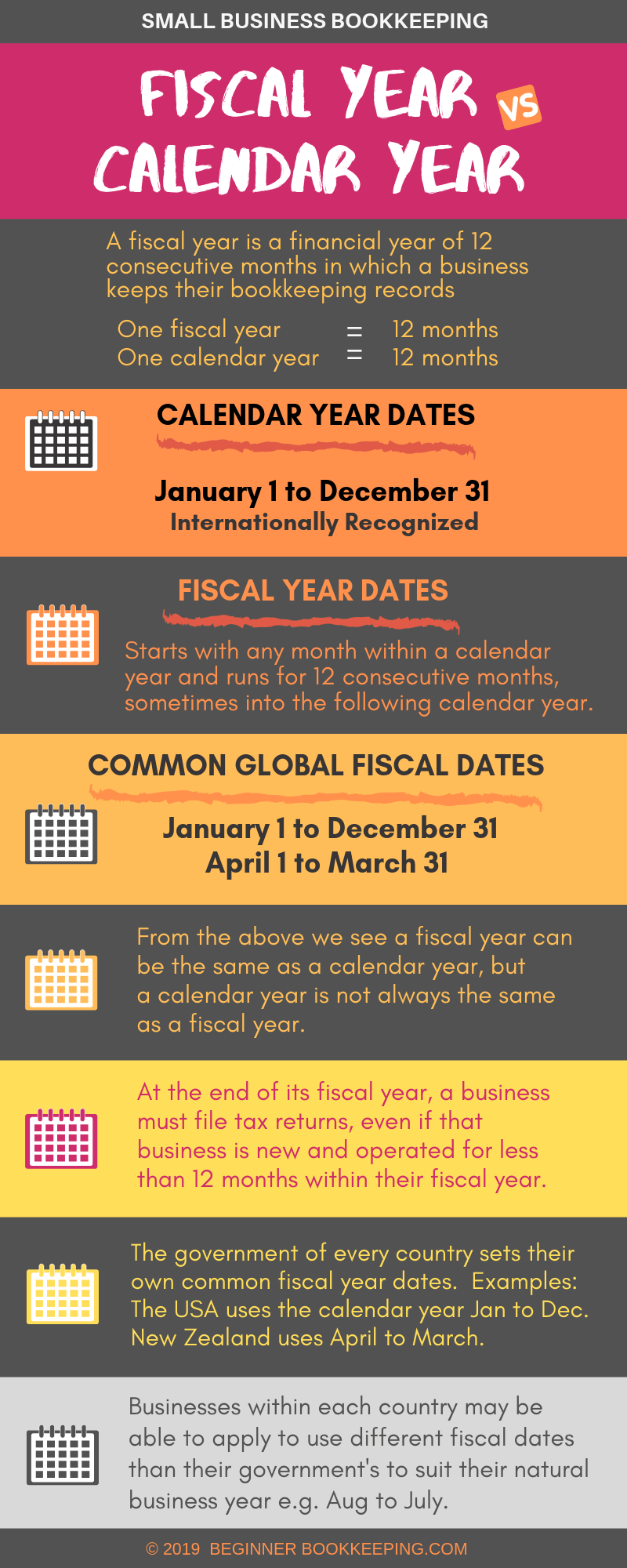

A fiscal year is also known as a financial year.

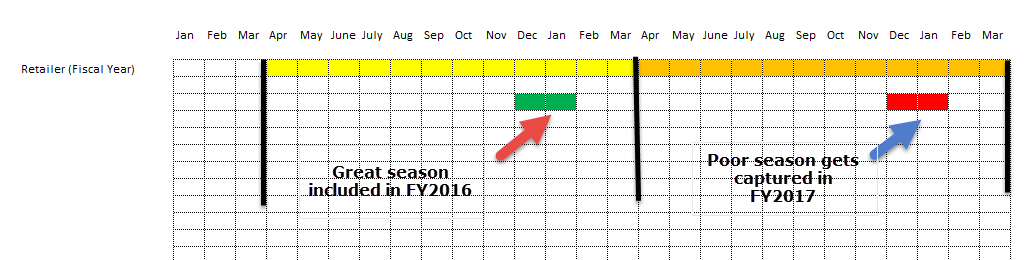

Businesses can use either the calendar year or the fiscal year (FY).

Calendar Year Vs Fiscal Year Taxes 2024. News Career development Fiscal Year vs. A "tax year" is an annual accounting period for keeping records and reporting income and expenses. Tax Years You must figure your taxable income on the basis of a tax year. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted fiscal year. A tax year can be a calendar tax year or a fiscal tax year, but what you're probably most interested in is a tax year as it relates to your income taxes.

Calendar Year Vs Fiscal Year Taxes 2024.